Alger Small Cap Focus Fund Class C (VWAGY)

12.14

-0.06 (-0.49%)

OP · Last Trade: Feb 14th, 6:13 PM EST

Detailed Quote

| Previous Close | 12.20 |

|---|---|

| Open | 12.10 |

| Bid | - |

| Ask | - |

| Day's Range | 12.10 - 12.20 |

| 52 Week Range | 9.197 - 12.83 |

| Volume | 103,202 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 124,218 |

Chart

News & Press Releases

Turning around its business in Europe will be a big win, but what it could learn from a Chinese rival might be even more valuable.

Via The Motley Fool · February 14, 2026

As of mid-February 2026, the energy storage sector is gripped by a singular narrative: the transition of QuantumScape (NYSE: QS) from a venture-backed research project into a tangible manufacturing entity. The stock, which has spent the better part of the last year oscillating between single-digit lows and mid-teen spikes, has

Via MarketMinute · February 13, 2026

Rivian (RIVN) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 13, 2026

VW Group Marks Production of 5 Millionth EV Drive Unit

Six years after producing its first battery-electric vehicle, Volkswagen Group has now manufactured its five millionth electric drive unit globally, underscoring the automaker’s rapid expansion in battery-electric vehicle powertrain manufacturing. The milestone reinforces VW’s standing among the world’s largest producers of EV drive systems as electrification accelerates across its brand portfolio.

Via Investor Brand Network · February 13, 2026

Deutsche Bank and UBS upgraded the stock, noting a favourable near-term risk-reward profile after its fourth-quarter results.

Via Stocktwits · February 13, 2026

OSLO, Norway — Tesla, Inc. (NASDAQ: TSLA) is facing a historic reckoning in the European theater as registration data for the first quarter of 2026 reveals a catastrophic collapse in demand across its most critical strongholds. Once the undisputed king of the electric vehicle (EV) revolution, the Austin-based automaker is now

Via MarketMinute · February 12, 2026

ECARX (ECX) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 12, 2026

Benchmark expects Q4 revenue of $1.27 billion with a narrower loss than consensus.

Via Stocktwits · February 12, 2026

QuantumScape (QS) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 11, 2026

As of February 11, 2026, the global economy is navigating the aftershocks of a geopolitical standoff that nearly dismantled the post-war trade order. The "Greenland Tariff Escalation," a high-stakes diplomatic confrontation sparked by the United States’ aggressive pursuit of the world’s largest island, has shifted from an imminent trade

Via MarketMinute · February 11, 2026

On February 11, 2026, BorgWarner Inc. (NYSE: BWA) finds itself at a historical crossroads. Long synonymous with the inner workings of the internal combustion engine (ICE), the Michigan-based Tier-1 supplier has spent the last five years aggressively shedding its legacy skin to emerge as a propulsion technology leader. Today’s market news—a major strategic pivot into [...]

Via Finterra · February 11, 2026

Tesla has lost its position as Europe’s top EV seller to Volkswagen. Here's what needs to change for TSLA stock to turn the narrative back in its favor in 2026.

Via Barchart.com · February 11, 2026

The solid-state battery maker could generate life-changing gains for patient investors.

Via The Motley Fool · February 10, 2026

QuantumScape stock rallies on the launch of its production-scale platform (Eagle Line). But does that warrant buying QS shares heading into the earnings print on Feb. 11?

Via Barchart.com · February 9, 2026

There's no denying that the technology being developed is the future. The question is, can this company actually adequately capitalize on this evolution?

Via The Motley Fool · February 8, 2026

Volkswagen has potentially found a way to roll out EVs while mitigating their short-term problems.

Via The Motley Fool · February 7, 2026

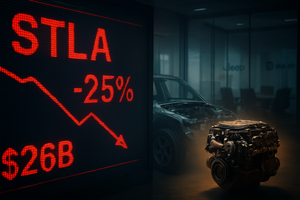

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

As the global automotive industry navigates a volatile transition toward electrification, Ford Motor Company (NYSE: F) finds itself at a defining crossroads. The Dearborn-based automaker is scheduled to release its fourth-quarter 2025 financial results on February 10, 2026, with Wall Street analysts laser-focused on a consensus earnings-per-share (EPS) estimate of

Via MarketMinute · February 6, 2026

The geopolitical landscape was rocked in early 2026 by the so-called "Greenland Episode," a diplomatic and economic confrontation that has pushed the relationship between the United States and the European Union to its lowest point in decades. What began as a renewed U.S. strategic interest in the Arctic territory

Via MarketMinute · February 6, 2026

BYD is the top dog in the Chinese auto market, but the world's largest EV market is set for a shock in 2026. Can BYD survive and thrive without help from Beijing?

Via The Motley Fool · February 6, 2026

As the first quarter of 2026 unfolds, the financial markets are navigating a paradoxical landscape defined by aggressive fiscal expansion and unprecedented geopolitical friction. While the "Stampeding Bull" of 2024 and 2025 was driven by a frenzy of price-to-earnings expansion and artificial intelligence (AI) hype, a new narrative has taken

Via MarketMinute · February 6, 2026

On February 6, 2026, the semiconductor landscape witnessed a jarring recalibration as Qualcomm Incorporated (NASDAQ: QCOM) shares plummeted 8.5% in a single trading session. The catalyst for this sharp correction was not a failure of innovation or a loss of market share, but rather a "structural bottleneck" described by management during their Q1 fiscal 2026 [...]

Via Finterra · February 6, 2026

The global economic landscape has been jolted in the opening weeks of 2026 as the United States government formalizes a series of aggressive 25% tariff proposals targeting the critical sectors of semiconductors, automobiles, and pharmaceuticals. These measures, framed as essential for national security and domestic industrial revitalization, have sent shockwaves

Via MarketMinute · February 5, 2026

As of February 5, 2026, Tesla Inc. (NASDAQ: TSLA) finds itself at the most critical juncture in its twenty-year history. Once viewed primarily as a disruptor of the internal combustion engine, the company has spent the last 24 months aggressively shedding its skin as a traditional automaker. Today, Tesla is increasingly valued and analyzed as [...]

Via Finterra · February 5, 2026

Rivian is an innovative EV company making some neat trucks and SUVs, but is it a buy at these prices?

Via The Motley Fool · February 5, 2026