News

January delivered the kind of mix investors and policymakers have been looking for: inflation cooled even as the labor market kept adding jobs.

Via Talk Markets · February 14, 2026

Sometimes, the stock market's greatest headwinds come from sources you'd least expect.

Via The Motley Fool · February 14, 2026

These companies are built to pay dividends for decades.

Via The Motley Fool · February 14, 2026

As investors weigh flat holiday sales and record-high credit card debt against rising hopes for Fed rate cuts, the next jobs report could prove pivotal for market direction and consumer-facing stocks.

Via The Motley Fool · February 14, 2026

This article shows Cleveland Fed nowcasts of instantaneous PCE and core PCE inflation drifting away from the Fed’s 2% target in recent data, signaling inflation dynamics that may complicate policy expectations.

Via Talk Markets · February 14, 2026

Anyone interested in this top digital asset must take the time to gain a better understanding.

Via The Motley Fool · February 13, 2026

This article discusses US Core CPI hitting economist consensus in January data, showing core inflation trends and divergences in food price components, with implications for ongoing inflation dynamics.

Via Talk Markets · February 13, 2026

Positive earnings pushed Applied Materials and Rivian Automotive higher as better-than-expected inflation data helped steady markets today, Feb. 13, 2026.

Via The Motley Fool · February 13, 2026

The financial landscape shifted violently this week as the long-dormant Russell 2000 index (INDEXRUSSELL:RUT) staged a breathtaking 18% rally, marking its best single-week performance in decades. Triggered by a surprisingly soft Consumer Price Index (CPI) report released on Wednesday, the surge has ignited what analysts are calling "The Great

Via MarketMinute · February 13, 2026

As the dust settles on the fourth-quarter 2025 earnings season, Martin Marietta Materials (NYSE: MLM) has emerged as a critical barometer for the health of the American industrial landscape. Reporting its results on February 11, 2026, the building materials giant showcased a bifurcated reality: while the broader economy grapples with

Via MarketMinute · February 13, 2026

The U.S. bond market experienced a significant easing on February 13, 2026, as the benchmark 10-year Treasury yield slid to 4.06% following a highly anticipated Consumer Price Index (CPI) report. The data, which showed inflation continuing its steady descent toward the Federal Reserve’s long-term target, provided a

Via MarketMinute · February 13, 2026

Following a tumultuous period of "fast-food fatigue" and inflationary pressure, McDonald’s (NYSE:MCD) has emerged from its fiscal 2025 fourth quarter as a definitive bellwether for the American economy. Two days ago, on February 11, 2026, the fast-food giant reported a "double beat" on revenue and earnings, signaling that

Via MarketMinute · February 13, 2026

This week’s market narrative revolved around three intersecting forces: the scale of AI capital investment, macroeconomic recalibration of Fed policy, and crypto-driven liquidity swings.

Via Talk Markets · February 13, 2026

As of February 13, 2026, the S&P 500 (NYSE: SPY) has officially crossed a psychological and mathematical Rubicon. The Shiller CAPE ratio—a measure of the market’s price relative to ten years of inflation-adjusted earnings—surpassed the 40.0 mark this week, currently hovering at 40.6. This

Via MarketMinute · February 13, 2026

In a move that has sent shockwaves through global financial centers, the White House has officially nominated Kevin Warsh to serve as the next Chairman of the Federal Reserve. Scheduled to take the gavel on May 15, 2026, Warsh will succeed Jerome Powell, whose second four-year term ends this spring.

Via MarketMinute · February 13, 2026

The world's second-largest cryptocurrency is up more than 7% today.

Via The Motley Fool · February 13, 2026

The mid-February 2026 market landscape has taken a sharp turn into volatility as a new wave of "AI disruption" fears sweeps through traditional service sectors. Long considered immune to the initial wave of generative AI, labor-intensive giants in logistics and real estate are now facing a reckoning. Investors, once enamored

Via MarketMinute · February 13, 2026

The U.S. Bureau of Labor Statistics released its highly anticipated January Consumer Price Index (CPI) report on the morning of February 13, 2026, revealing that headline inflation has slowed to 2.4% year-over-year. This figure came in below the consensus economist expectation of 2.5%, marking a significant milestone

Via MarketMinute · February 13, 2026

As gold covers a lot of ground, while silver looks to follow suit, should you wait for another big pullback or get in now.

Via The Motley Fool · February 13, 2026

Goolsbee said that inflation is stuck at 3% and that’s not acceptable.

Via Stocktwits · February 13, 2026

Silver climbs to $77.20 after softer US CPI boosts expectations of Fed easing.

Via Talk Markets · February 13, 2026

Bitcoin's 5% rise today has some investors questioning whether reversing course on bearish bets makes sense.

Via The Motley Fool · February 13, 2026

SoFi and Adyen are still worth buying in this frothy market.

Via The Motley Fool · February 13, 2026

The near-term path is disinflationary, but the macro is now clearly inflationary.

Via Talk Markets · February 13, 2026

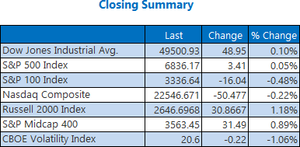

Stocks closed mixed on Friday, as investors unpacked this morning's soft inflation data.

Via Talk Markets · February 13, 2026