Mid Cap SPDR 400 Trust, Series 1 (MDY)

631.38

+5.34 (0.85%)

NYSE · Last Trade: Jan 9th, 11:03 PM EST

Detailed Quote

| Previous Close | 626.04 |

|---|---|

| Open | 628.50 |

| Day's Range | 626.11 - 632.21 |

| 52 Week Range | 458.82 - 632.21 |

| Volume | 850,776 |

| Market Cap | 251.87M |

| Dividend & Yield | 8.736 (1.38%) |

| 1 Month Average Volume | 909,154 |

Chart

News & Press Releases

Fluor is one of the oldest, continuously operating construction and engineering firms in the country. It is also actively working to reboot its business.

Via The Motley Fool · November 27, 2025

Texas-based Fluor has trailed the market for most of the year, but a winning bet on the future of nuclear power is paying off big and drawing new attention to the global construction and engineering company.

Via The Motley Fool · November 15, 2025

GameStop looks as much like a value trap as a turnaround play.

Via The Motley Fool · November 6, 2025

No gimmicks or trend-following here. Just baskets of quality names that should be driven higher by the global economy's ongoing growth.

Via The Motley Fool · September 18, 2025

Williams-Sonoma Climbs After ‘Buy’ Call From Analyst On Improving Market Trends: Retail Turns Bullishstocktwits.com

Via Stocktwits · July 24, 2025

A new market leader has snuck into town over the past month as Small Caps have pushed to the top of the leader board. Whether the trend lasts, or not, will depend a lot on what the Fed does, but one thing is certain; after a year of tech-led mega caps setting new highs, investors have clearly shown an increased appetite for risk in the form of smaller, lesser known names.

Via The Motley Fool · September 16, 2025

The combined company would be 53.5% owned by Chart shareholders and 46.5% by Flowserve shareholders on a fully diluted basis.

Via Stocktwits · June 4, 2025

The announcement follows a slew of price cuts from analysts after the company’s second-quarter outlook disappointed Wall Street.

Via Stocktwits · May 14, 2025

A nearly 20-year Amazon veteran, Nader Kabbani said he was drawn to Hims & Hers by its potential to expand access to fast, reliable, and high-quality care.

Via Stocktwits · May 5, 2025

Amazon has also reportedly canceled some orders from Asia as companies review their import plans.

Via Stocktwits · April 10, 2025

Sentiment on Stocktwits ended in the ‘extremely bullish’ zone on Friday.

Via Stocktwits · March 24, 2025

Jefferies lowered the company’s price target to $208 from $226 with a ‘Buy’ rating.

Via Stocktwits · March 20, 2025

On Stocktwits, the sentiment for the stock swung to 'extremely bullish' from 'extremely bearish', and chatter rose a whopping 2,100% from a day prior.

Via Stocktwits · March 20, 2025

An analysis and commentary on the financial markets.

Via Talk Markets · March 14, 2025

The company said it is on track to achieve its two-year resource efficiency transformation plan announced in September 2024.

Via Stocktwits · March 11, 2025

Williams-Sonoma is scheduled to report its fiscal fourth-quarter earnings on Wednesday.

Via Stocktwits · March 10, 2025

The company plans to boost new store openings in 2025 above its 10% annual growth target and open about 75 units.

Via Stocktwits · February 28, 2025

An analysis and commentary on the financial markets.

Via Talk Markets · February 14, 2025

According to the analyst report, a "storm is brewing" in the U.S. consumer discretionary sector

Via Stocktwits · February 4, 2025

Whirlpool said it expects to pay down about $700 million of debt in 2025.

Via Stocktwits · January 30, 2025

Goldman Sachs sees temporary setback, not bear market. High market concentration poses risk but also opportunity to diversify and stay invested.

Via Benzinga · January 29, 2025

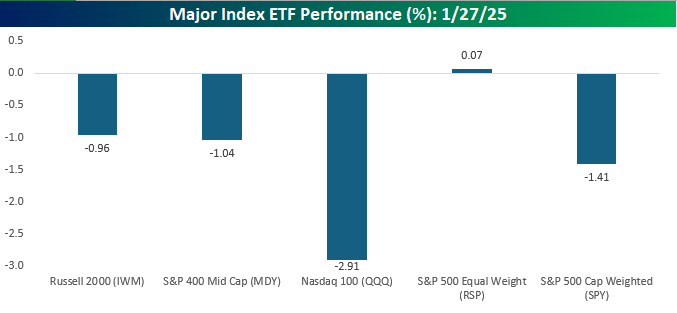

In looking at the performance of various indices and individual stocks yesterday, the market's behavior looked more discerning than indiscriminate.

Via Talk Markets · January 28, 2025

BofA upgraded Travel + Leisure to ‘Buy’ from ‘Underperform’ with a price target of $60

Via Stocktwits · January 28, 2025

Last quarter, the company’s EPS stood at $3.43 on revenues of $3.99 billion.

Via Stocktwits · January 27, 2025