Invesco KBW Bank ETF (KBWB)

78.16

+0.00 (0.00%)

NASDAQ · Last Trade: Nov 11th, 6:56 AM EST

Detailed Quote

| Previous Close | 78.16 |

|---|---|

| Open | - |

| Day's Range | N/A - N/A |

| 52 Week Range | 51.13 - 80.04 |

| Volume | 0 |

| Market Cap | - |

| Dividend & Yield | 1.808 (2.31%) |

| 1 Month Average Volume | 2,631,547 |

Chart

News & Press Releases

Avanda Disclosed Complete Sale of 438K KBWB Shares Valued at $31.3 Million

Via The Motley Fool · November 10, 2025

Howard Marks' new memo warns of 'cockroaches.' Why he says recent frauds are 'systematic' clusters, not a 'systemic' financial threat.

Via Benzinga · November 7, 2025

BofA analysts said that management will need strong communication on credit risk to restore confidence.

Via Stocktwits · October 20, 2025

Treasury Secretary Scott Bessent Calls For Fundamental Reset Of Federal Reserve, Overhaul Of ‘Antiquated’ Bank Capital Normsstocktwits.com

Via Stocktwits · July 21, 2025

Citi’s Stock Jumps To 17-Year High After Q2 Earnings Beat, $4B Buyback Planstocktwits.com

Via Stocktwits · July 15, 2025

JPMorgan capped off its strong outperformance in 2025 with a big earnings beat in Q3. However, does this strong and steady gainer face resistance going forward?

Via MarketBeat · October 19, 2025

Stocks were higher for the week as investors overlooked tariff uncertainty, but the bulls may get tested by next week's data on inflation and retail sales

Via MarketBeat · August 9, 2025

The financials sector has been strong all year, and with interest rate cuts on the table later this year, investors looking for exposure can turn to this ETF.

Via MarketBeat · August 4, 2025

The JPMorgan CEO noted that tampering with the Fed’s autonomy could disrupt economic stability, calling such interference risky.

Via Stocktwits · July 15, 2025

Citi’s net income jumped to $4 billion in the second quarter, compared to $3.2 billion in the year-ago quarter, which the management said was driven by higher revenues.

Via Stocktwits · July 15, 2025

Former U.K. Prime Minister Rishi Sunak’s appointment at Goldman Sachs at Senior Adviser marks his return to Wall Street more than two decades after leaving.

Via Stocktwits · July 8, 2025

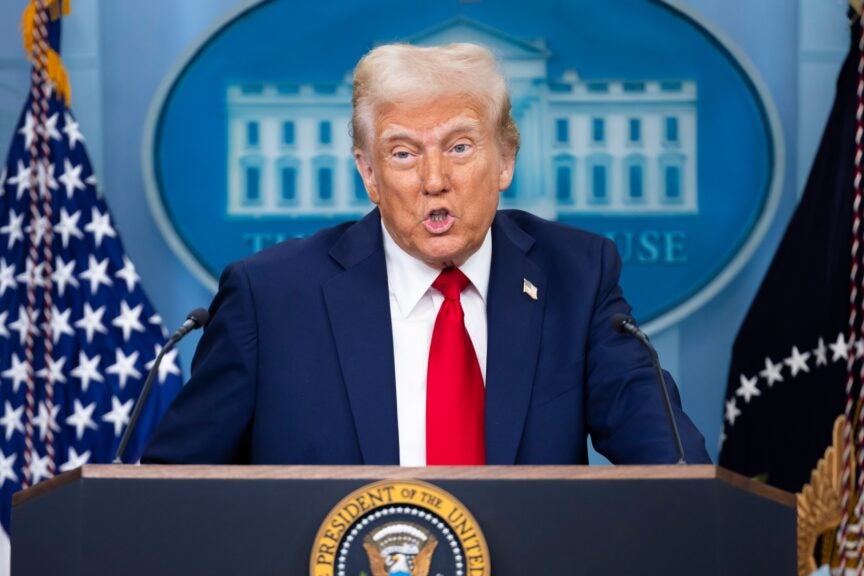

As Donald Trump's administration nears completion of a proposal to ease big bank rules, they are largely expected to cheer the lower SLR.

Via Benzinga · June 2, 2025

Wells Fargo to sell rail assets to joint venture for $4.4 billion, with GATX and Brookfield owning 30% and 70% respectively. Deal expected to close by Q1 2026.

Via Benzinga · May 30, 2025

Bank of America disclosed expansion plans; the goal is to open over 150 new locations across 60 markets by the end of 2027.

Via Benzinga · May 13, 2025

Goldman Sachs (NYSE:GS) reported higher first-quarter results, with revenue of $15.06 billion beating expectations at $14.81 billion. Net interest income also rose. Global Banking & Markets saw a 10% increase in revenue, while Investment Banking fees declined 8%. The company also approved a $40 billion stock buyback program and declared a dividend of $3.00 per share.

Via Benzinga · April 14, 2025

State Street Corporation (NYSE: STT) shares down premarket on Thursday as State Street Global Advisors announces strategic partnership and investment in Ethic Inc.

Via Benzinga · April 3, 2025

A Bloomberg report said that the move is aimed at reining costs as executives grapple with minimal attrition in their ranks.

Via Stocktwits · March 19, 2025

After an aggressive regulatory agenda under the Biden administration, banks are now poised to benefit from lighter regulatory scrutiny under the new administration.

Via Talk Markets · February 16, 2025

A CFPB shut down raises concerns about consumer rights but also presents opportunity for investors in bank and fintech ETFs.

Via Benzinga · February 11, 2025

In this week's video, we'll review the latest charts and data help us answer the question, prudent selling based on inflation fears or an overreaction?

Via Talk Markets · February 7, 2025

Fed dials back regulatory burden on major US banks, ending climate stress test and rolling out more favorable 2025 scenario. Relief for Goldman Sachs and Morgan Stanley expected.

Via Benzinga · February 6, 2025

See which sectors performed best and worst under Trumps first term. One sector in particular stands to benefit significantly under Trump 2.0.

Via MarketBeat · February 1, 2025

The lender’s net interest income (NII) declined 4.4% sequentially, hurt by decreased yields on interest-earning assets.

Via Stocktwits · January 28, 2025

The wealth manager’s total trust, investment, and other servicing fees rose 12% to $1.22 billion during the fourth quarter.

Via Stocktwits · January 23, 2025

Morgan Stanley reports strong Q4 results, beating expectations for EPS and revenue. Analyst expects outperformance and potential EPS upgrades.

Via Benzinga · January 16, 2025