Agriculture products company SiteOne Landscape Supply (NYSE:SITE) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 3.4% year on year to $1.46 billion. Its GAAP profit of $2.86 per share was 0.5% below analysts’ consensus estimates.

Is now the time to buy SiteOne? Find out by accessing our full research report, it’s free.

SiteOne (SITE) Q2 CY2025 Highlights:

- Revenue: $1.46 billion vs analyst estimates of $1.47 billion (3.4% year-on-year growth, in line)

- EPS (GAAP): $2.86 vs analyst expectations of $2.88 (0.5% miss)

- Adjusted EBITDA: $226.7 million vs analyst estimates of $221.5 million (15.5% margin, 2.4% beat)

- EBITDA guidance for the full year is $415 million at the midpoint, above analyst estimates of $405.6 million

- Operating Margin: 12.8%, in line with the same quarter last year

- Free Cash Flow Margin: 8.4%, down from 9.6% in the same quarter last year

- Organic Revenue was flat year on year (-3.2% in the same quarter last year)

- Market Capitalization: $5.76 billion

“We are pleased to report continued solid results in the second quarter with 3% Net sales growth and 8% growth in Adjusted EBITDA1, despite softer end markets. We are executing our initiatives well, achieving excellent SG&A leverage, good gross margin improvement, and continuing to gain market share,” said Doug Black, SiteOne’s Chairman and CEO.

Company Overview

Known for distributing John Deere tractors and LESCO turf care products, SiteOne Landscape Supply (NYSE:SITE) provides landscaping products and services to professionals, including irrigation, lighting, and nursery supplies.

Revenue Growth

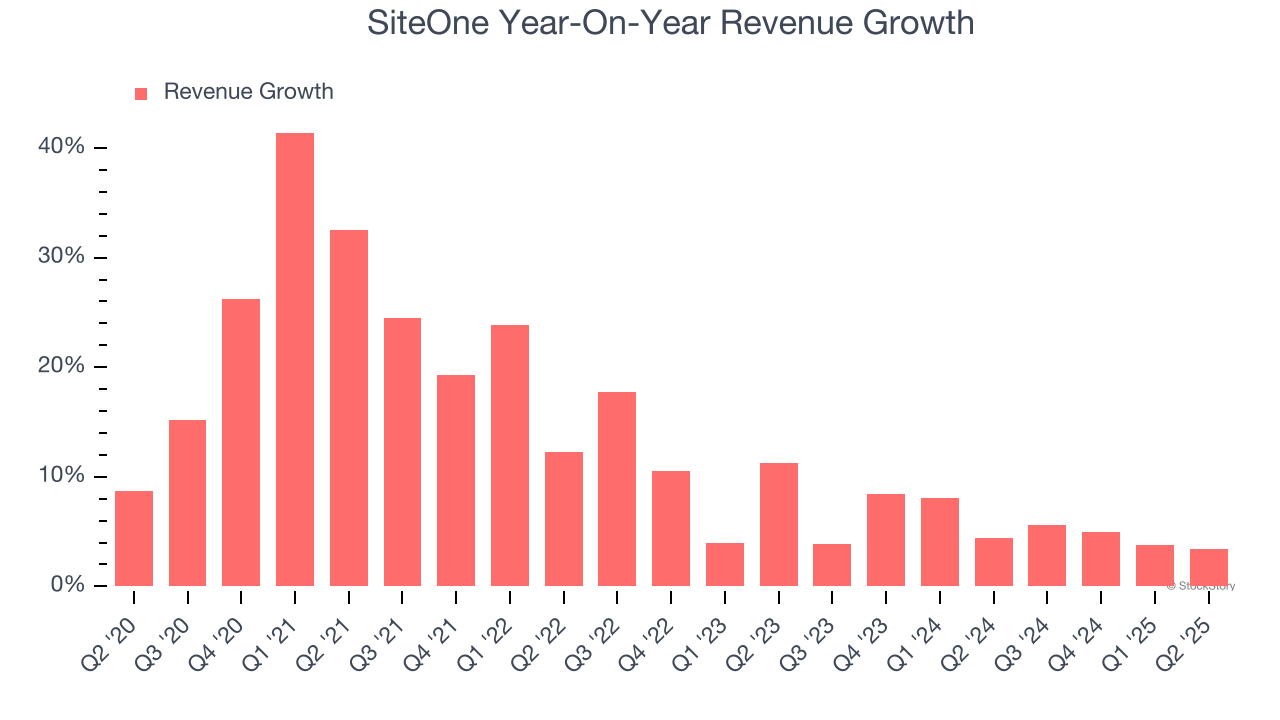

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, SiteOne’s 13.4% annualized revenue growth over the last five years was excellent. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. SiteOne’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 5.1% over the last two years was well below its five-year trend.

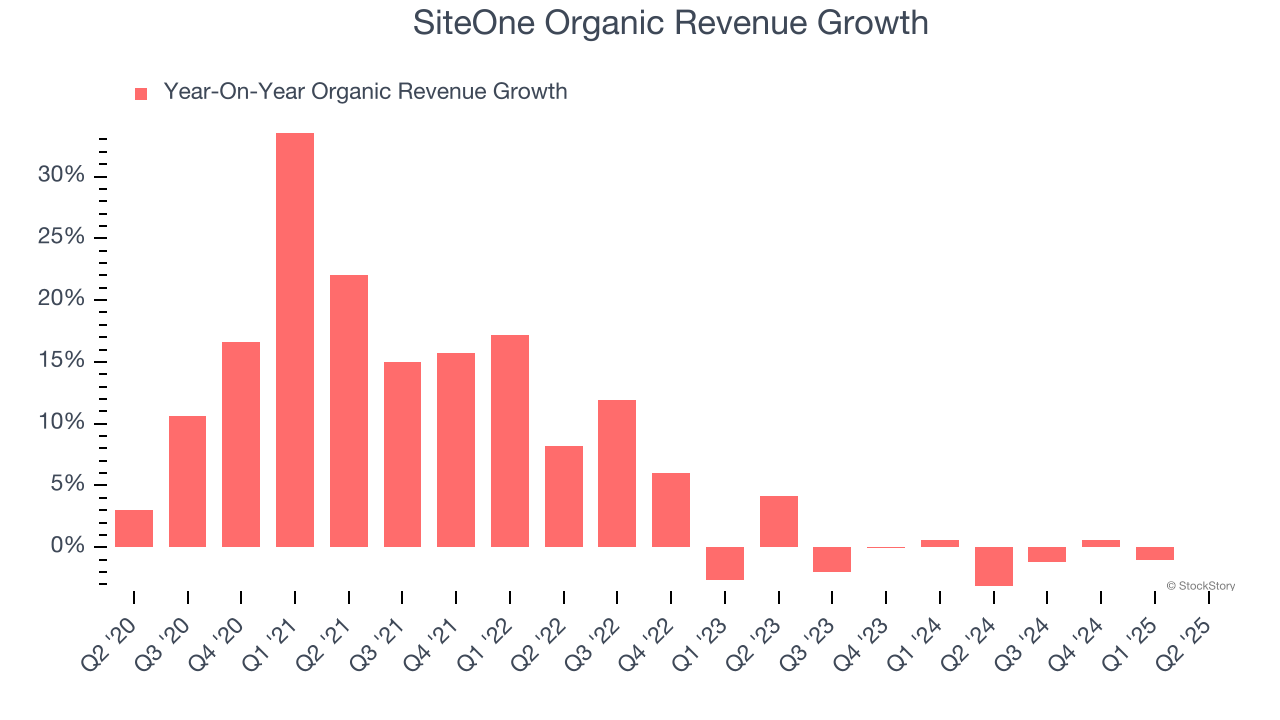

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, SiteOne’s organic revenue was flat. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, SiteOne grew its revenue by 3.4% year on year, and its $1.46 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

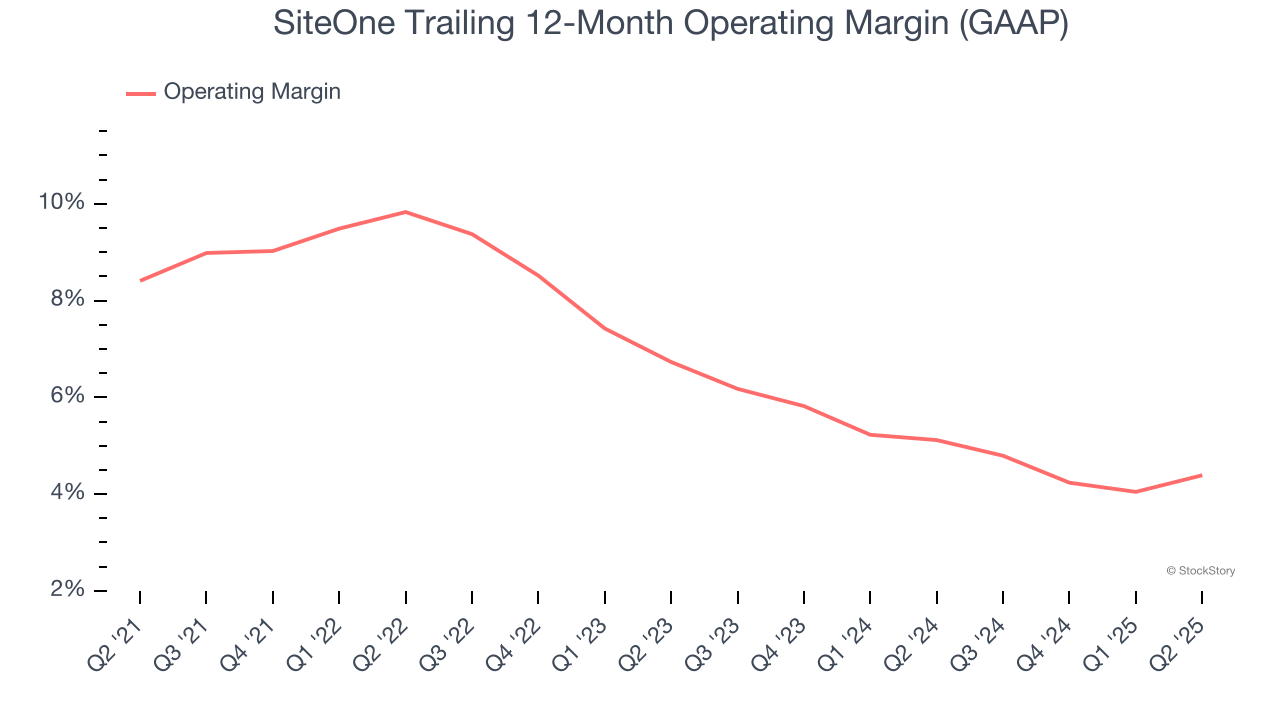

SiteOne was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.7% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, SiteOne’s operating margin decreased by 4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. SiteOne’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q2, SiteOne generated an operating margin profit margin of 12.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

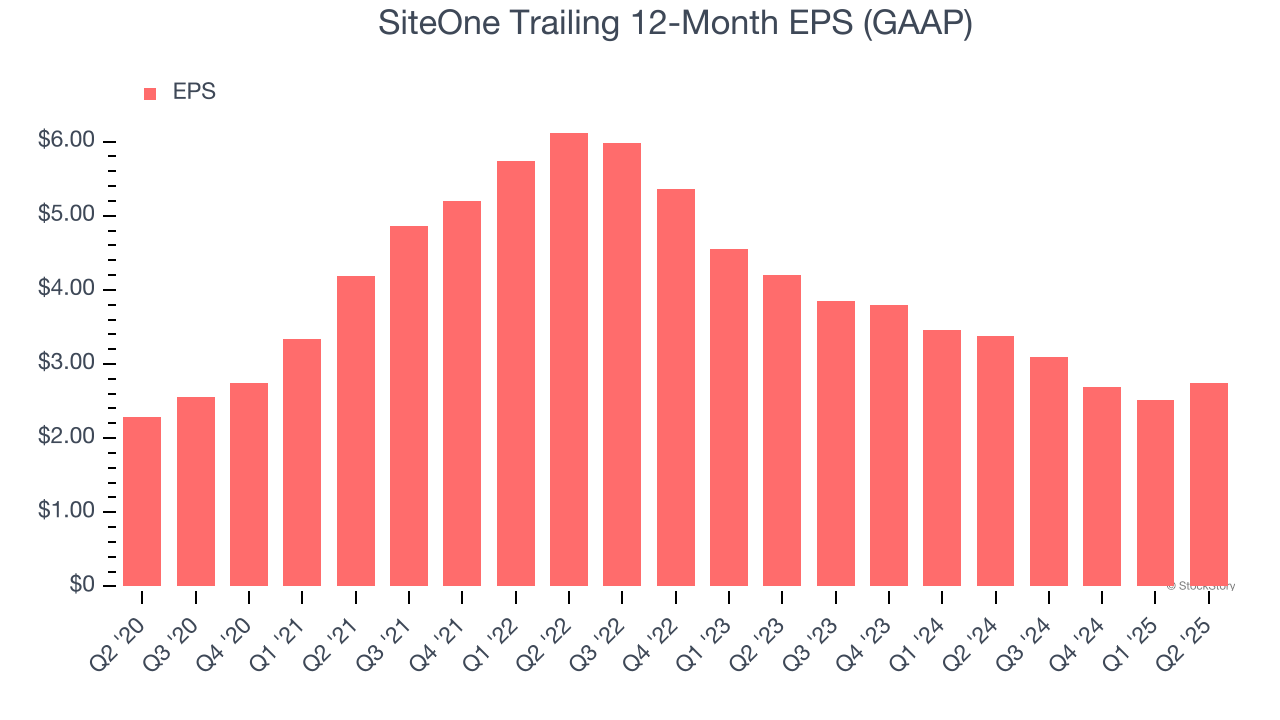

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

SiteOne’s EPS grew at a weak 3.7% compounded annual growth rate over the last five years, lower than its 13.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

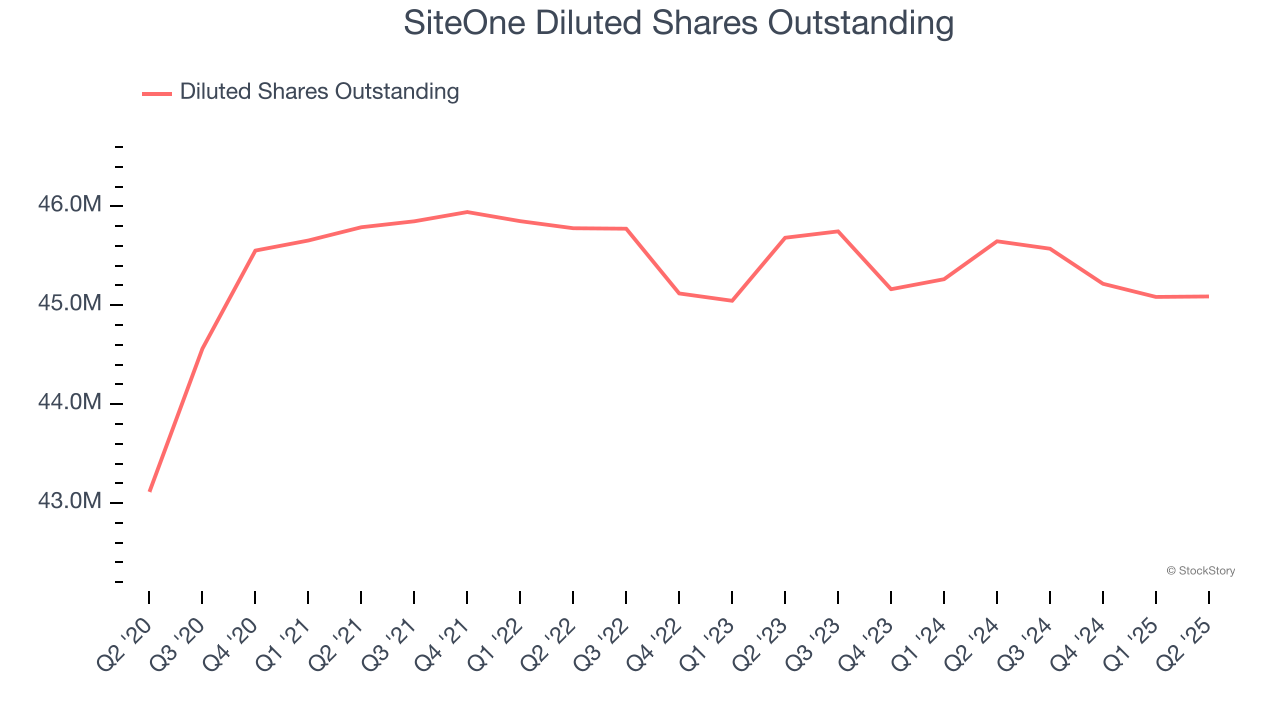

Diving into the nuances of SiteOne’s earnings can give us a better understanding of its performance. As we mentioned earlier, SiteOne’s operating margin was flat this quarter but declined by 4 percentage points over the last five years. Its share count also grew by 4.6%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For SiteOne, its two-year annual EPS declines of 19.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q2, SiteOne reported EPS at $2.86, up from $2.63 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects SiteOne’s full-year EPS of $2.74 to grow 32.5%.

Key Takeaways from SiteOne’s Q2 Results

It was great to see SiteOne’s full-year EBITDA guidance top analysts’ expectations. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue was in line and its organic revenue fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $128.57 immediately following the results.

Is SiteOne an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.