Over the past six months, Campbell’s stock price fell to $32.23. Shareholders have lost 16.5% of their capital, which is disappointing considering the S&P 500 has climbed by 3.1%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Campbell's, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Campbell's Not Exciting?

Despite the more favorable entry price, we're cautious about Campbell's. Here are three reasons why there are better opportunities than CPB and a stock we'd rather own.

1. Demand Slipping as Sales Volumes Decline

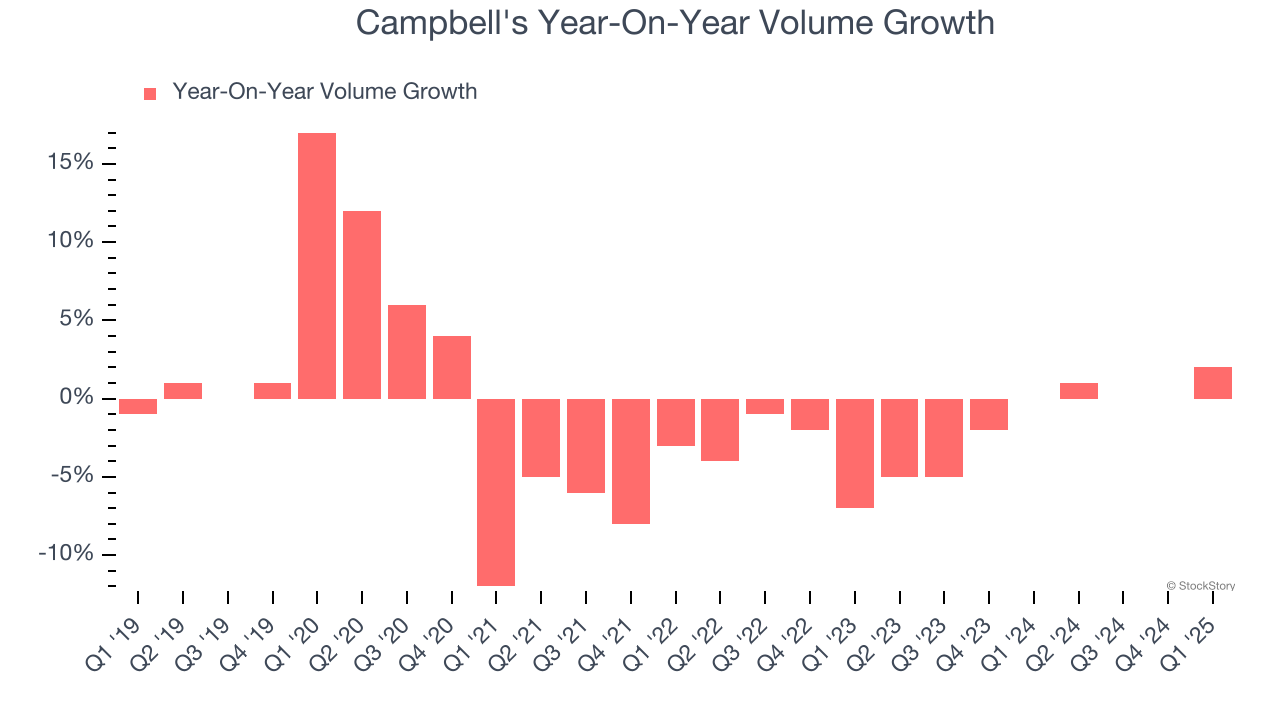

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Campbell’s average quarterly sales volumes have shrunk by 1.1% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Campbell’s revenue to stall, a deceleration versus This projection doesn't excite us and implies its products will see some demand headwinds.

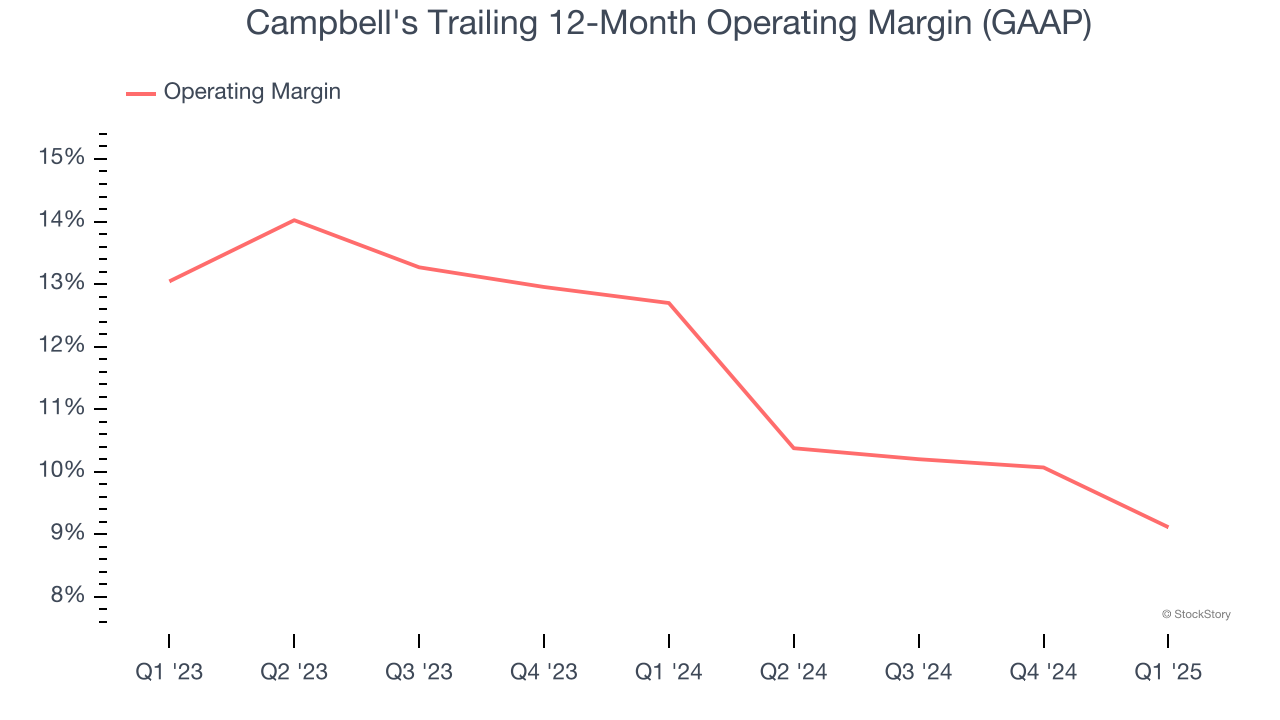

3. Shrinking Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

Analyzing the trend in its profitability, Campbell’s operating margin decreased by 3.6 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 9.1%.

Final Judgment

Campbell's isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 10.6× forward P/E (or $32.23 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Campbell's

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.