Regional banking company First Busey (NASDAQ:BUSE) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 70.4% year on year to $198 million. Its GAAP profit of $0.52 per share was 15% below analysts’ consensus estimates.

Is now the time to buy First Busey? Find out by accessing our full research report, it’s free.

First Busey (BUSE) Q2 CY2025 Highlights:

- Net Interest Income: $153.2 million vs analyst estimates of $152.9 million (85.8% year-on-year growth, in line)

- Net Interest Margin: 3.5% vs analyst estimates of 3.4% (46 basis point year-on-year increase, 5.4 bps beat)

- Revenue: $198 million vs analyst estimates of $193.3 million (70.4% year-on-year growth, 2.4% beat)

- Efficiency Ratio: 63.9% vs analyst estimates of 58.2% (5.7 percentage point miss)

- EPS (GAAP): $0.52 vs analyst expectations of $0.61 (15% miss)

- Market Capitalization: $2.16 billion

Company Overview

Tracing its roots back to 1868 during America's post-Civil War reconstruction era, First Busey (NASDAQ:BUSE) is a bank holding company that provides commercial and retail banking, wealth management, and payment technology solutions across Illinois, Missouri, Florida, and Indiana.

Sales Growth

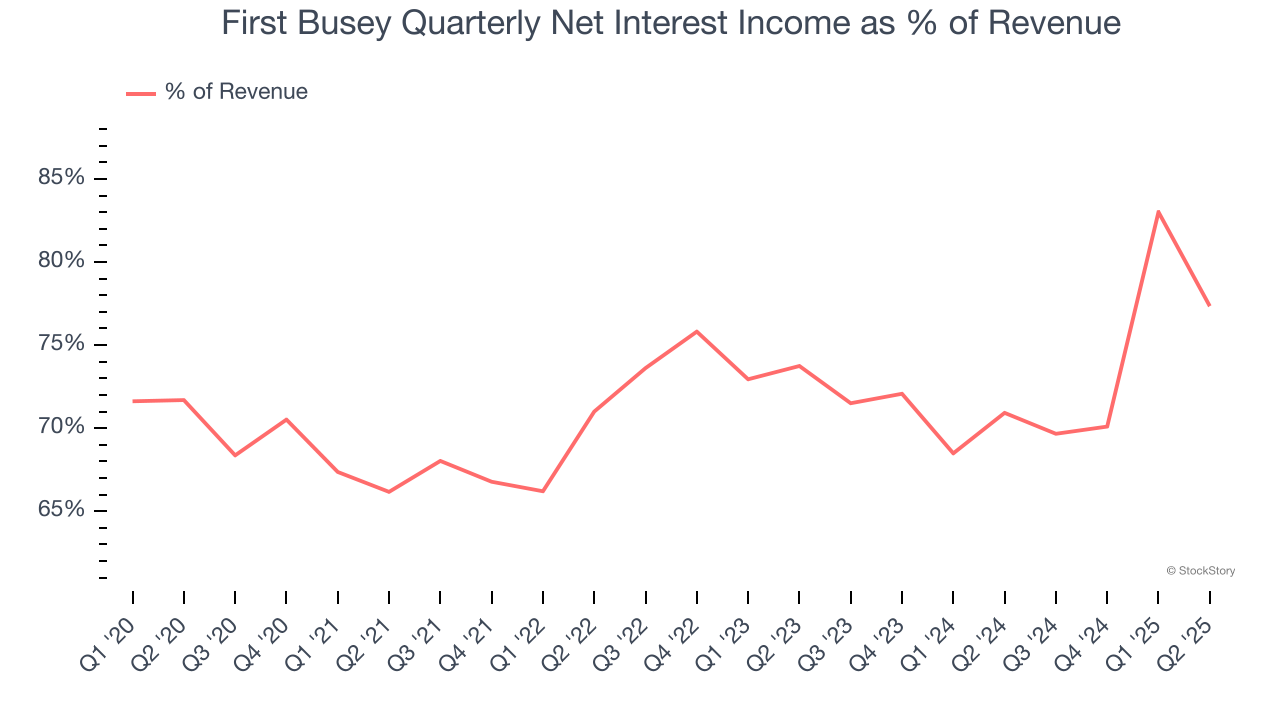

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income.

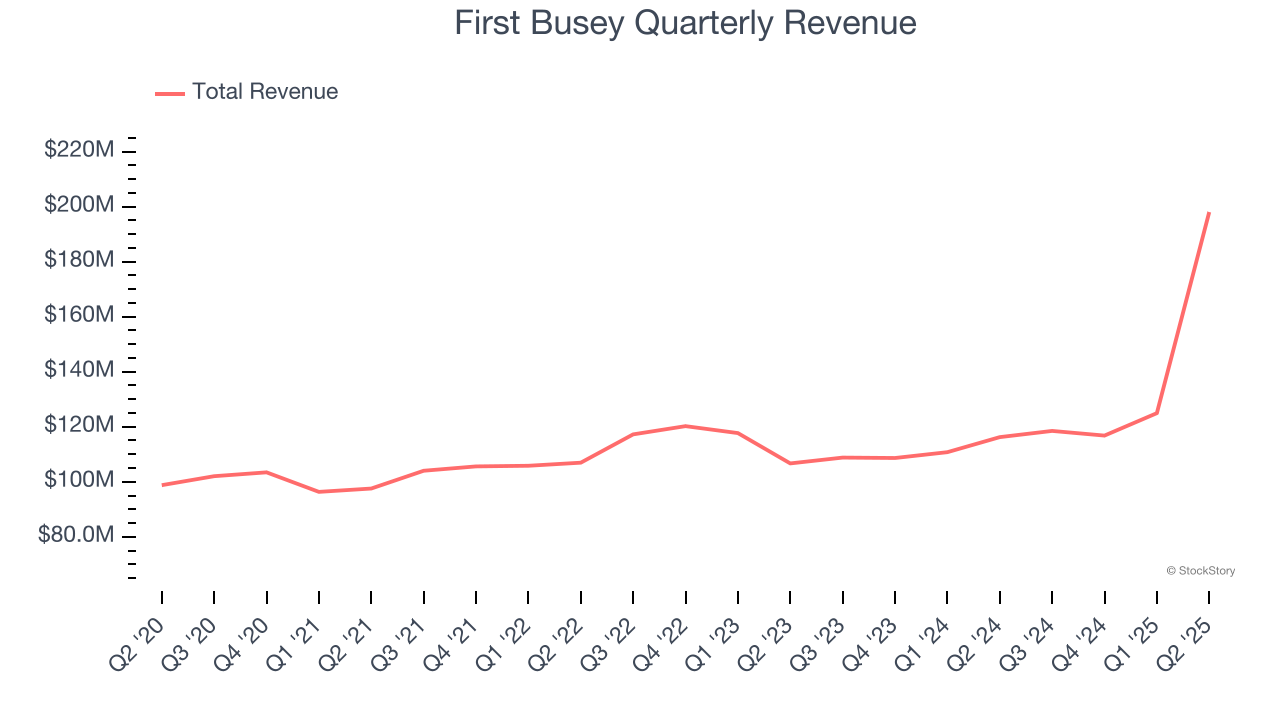

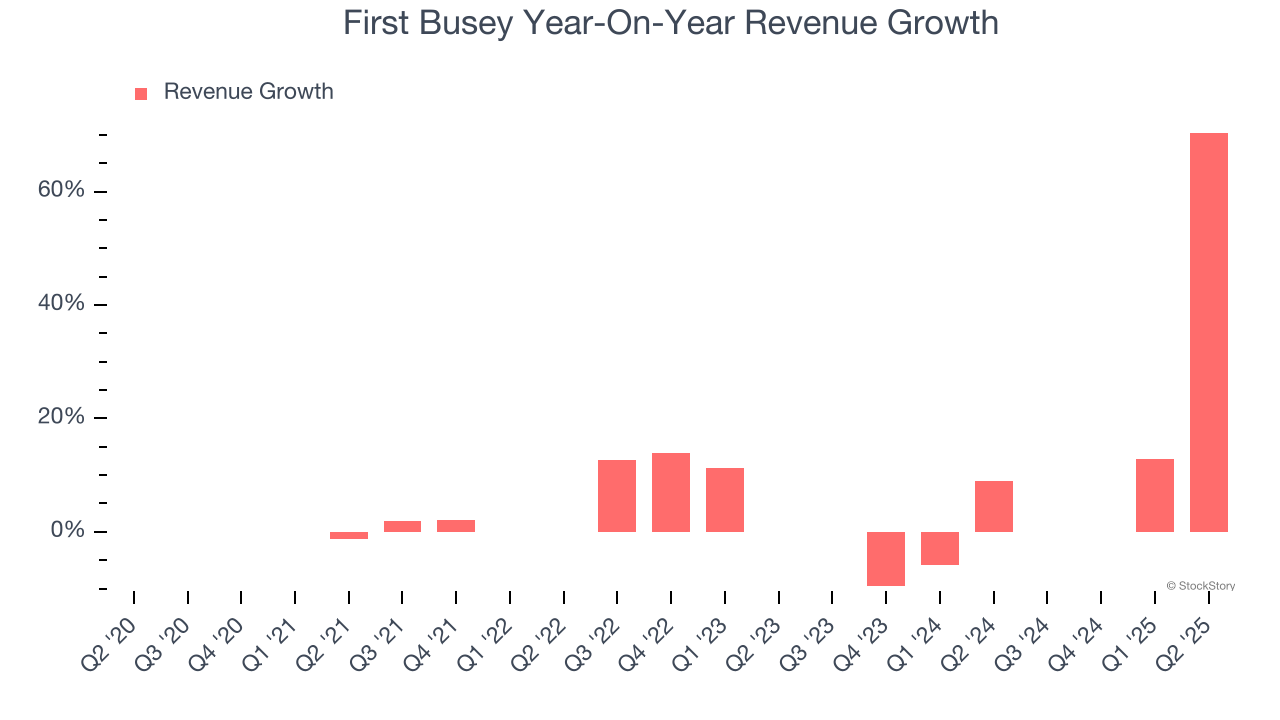

Over the last five years, First Busey grew its revenue at a decent 6.7% compounded annual growth rate. Its growth was slightly above the average bank company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. First Busey’s annualized revenue growth of 9.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, First Busey reported magnificent year-on-year revenue growth of 70.4%, and its $198 million of revenue beat Wall Street’s estimates by 2.4%.

Net interest income made up 71.2% of the company’s total revenue during the last five years, meaning lending operations are First Busey’s largest source of revenue.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Tangible Book Value Per Share (TBVPS)

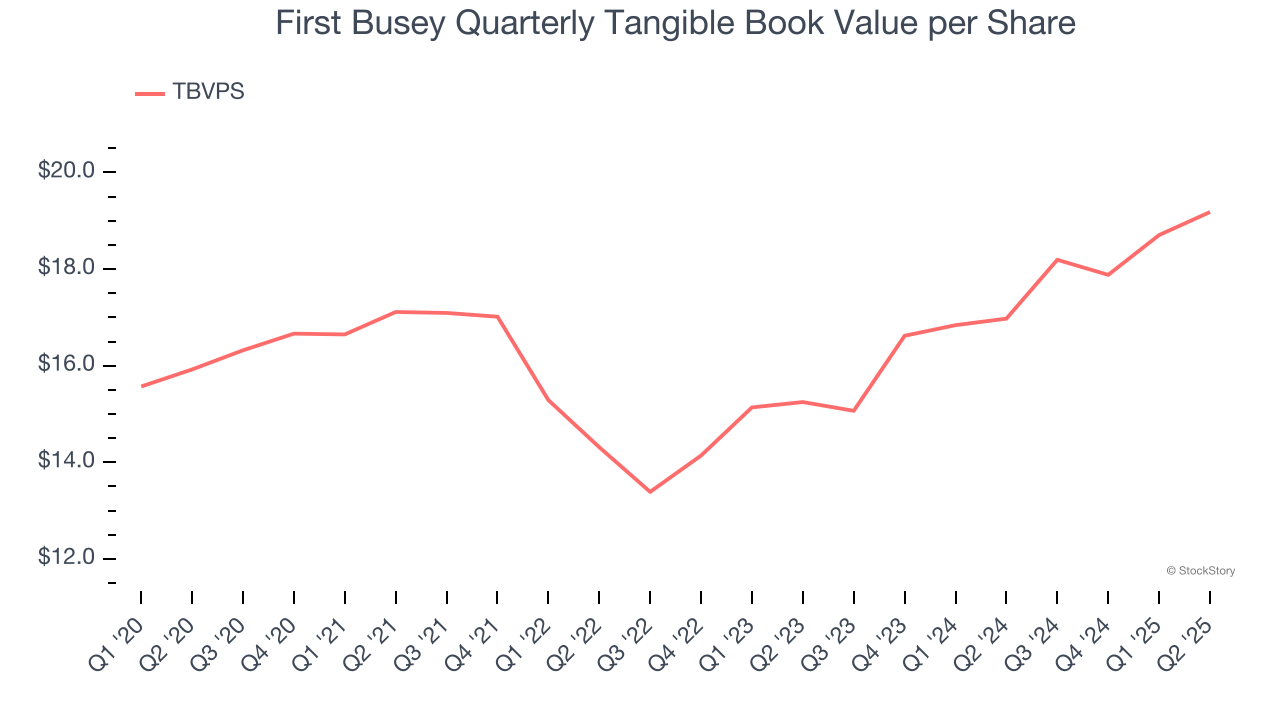

Banks operate as balance sheet businesses, with profits generated through borrowing and lending activities. Valuations reflect this reality, emphasizing balance sheet strength and long-term book value compounding ability.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. EPS can become murky due to acquisition impacts or accounting flexibility around loan provisions, and TBVPS resists financial engineering manipulation.

First Busey’s TBVPS grew at a tepid 3.8% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 12.2% annually over the last two years from $15.25 to $19.18 per share.

Over the next 12 months, Consensus estimates call for First Busey’s TBVPS to grow by 10.6% to $21.21, solid growth rate.

Key Takeaways from First Busey’s Q2 Results

It was encouraging to see First Busey beat analysts’ revenue and NIM expectations this quarter. We were also happy its tangible book value per share narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this quarter was mixed. The stock remained flat at $24.26 immediately after reporting.

Is First Busey an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.