Jazz Pharmaceuticals currently trades at $109.85 per share and has shown little upside over the past six months, posting a small loss of 1.4%.

Is there a buying opportunity in Jazz Pharmaceuticals, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

We don't have much confidence in Jazz Pharmaceuticals. Here are three reasons why JAZZ doesn't excite us and a stock we'd rather own.

Why Is Jazz Pharmaceuticals Not Exciting?

Originally founded in 2003 and now headquartered in Ireland following a 2012 tax inversion merger, Jazz Pharmaceuticals (NASDAQGS:JAZZ) develops and markets medicines for sleep disorders, epilepsy, and cancer, with a focus on treatments for patients with limited therapeutic options.

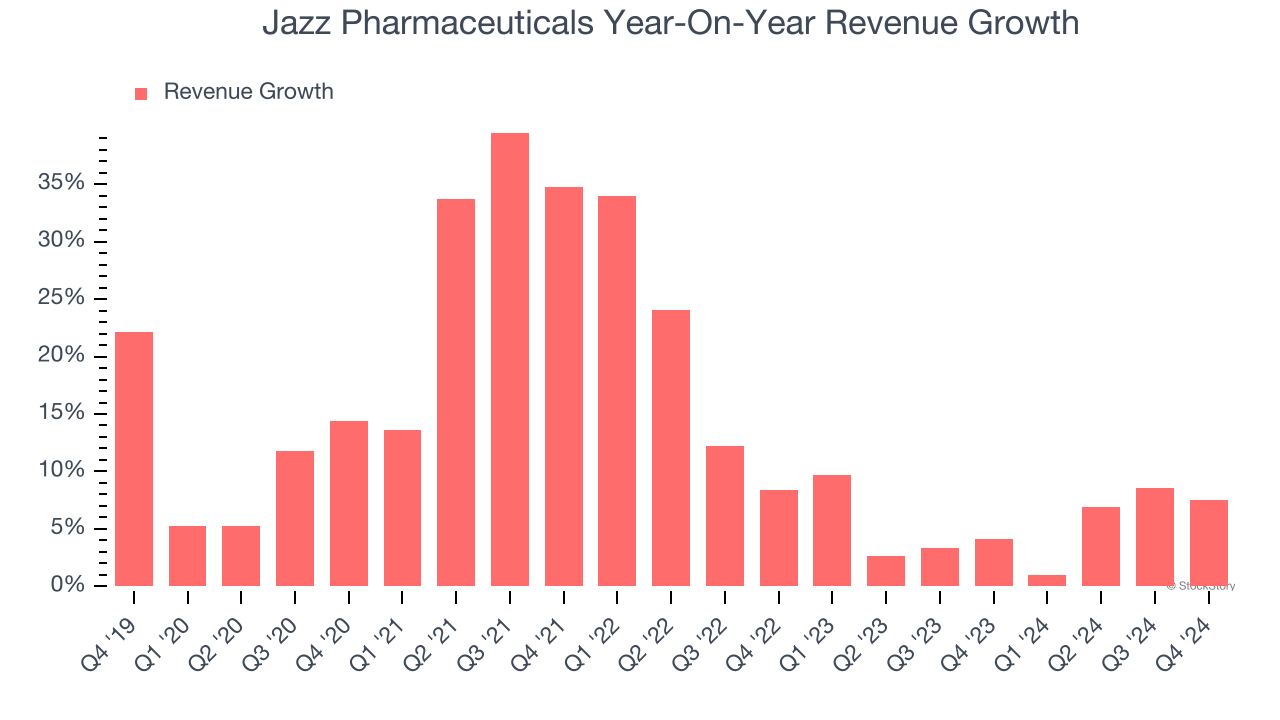

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. Jazz Pharmaceuticals’s recent performance shows its demand has slowed as its annualized revenue growth of 5.4% over the last two years was below its five-year trend.

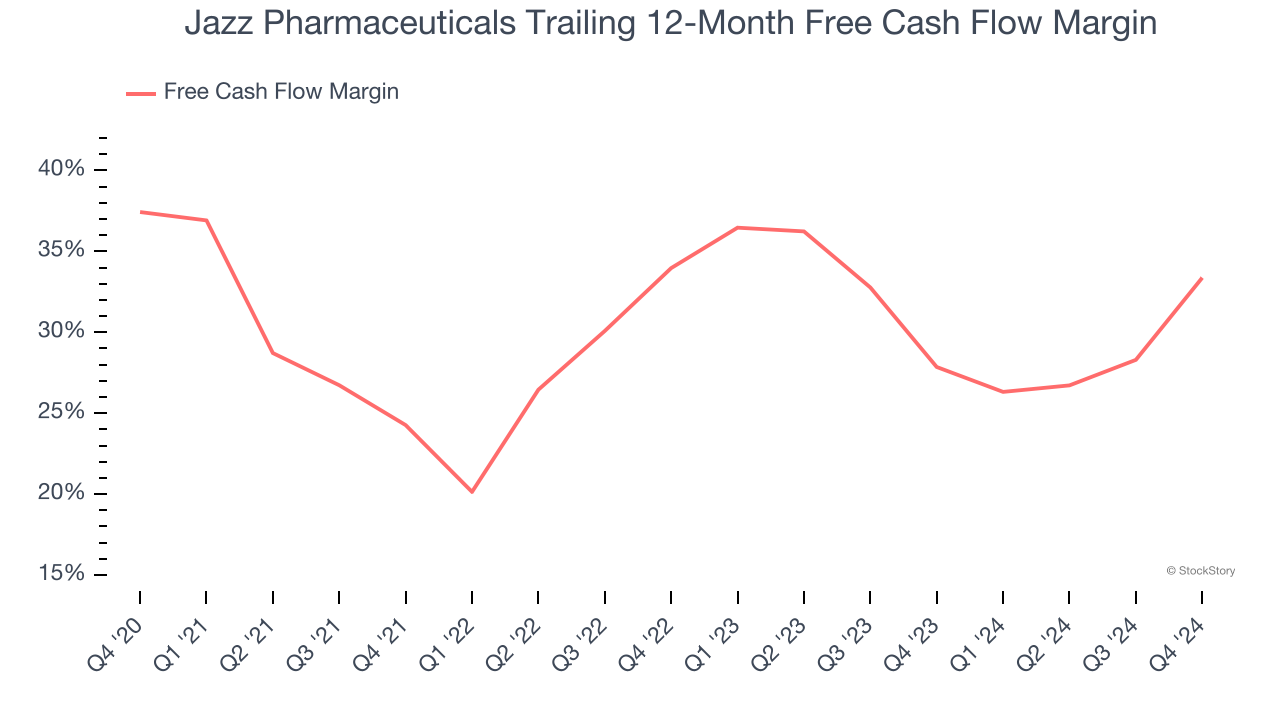

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Jazz Pharmaceuticals’s margin dropped by 4.1 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Jazz Pharmaceuticals’s free cash flow margin for the trailing 12 months was 33.4%.

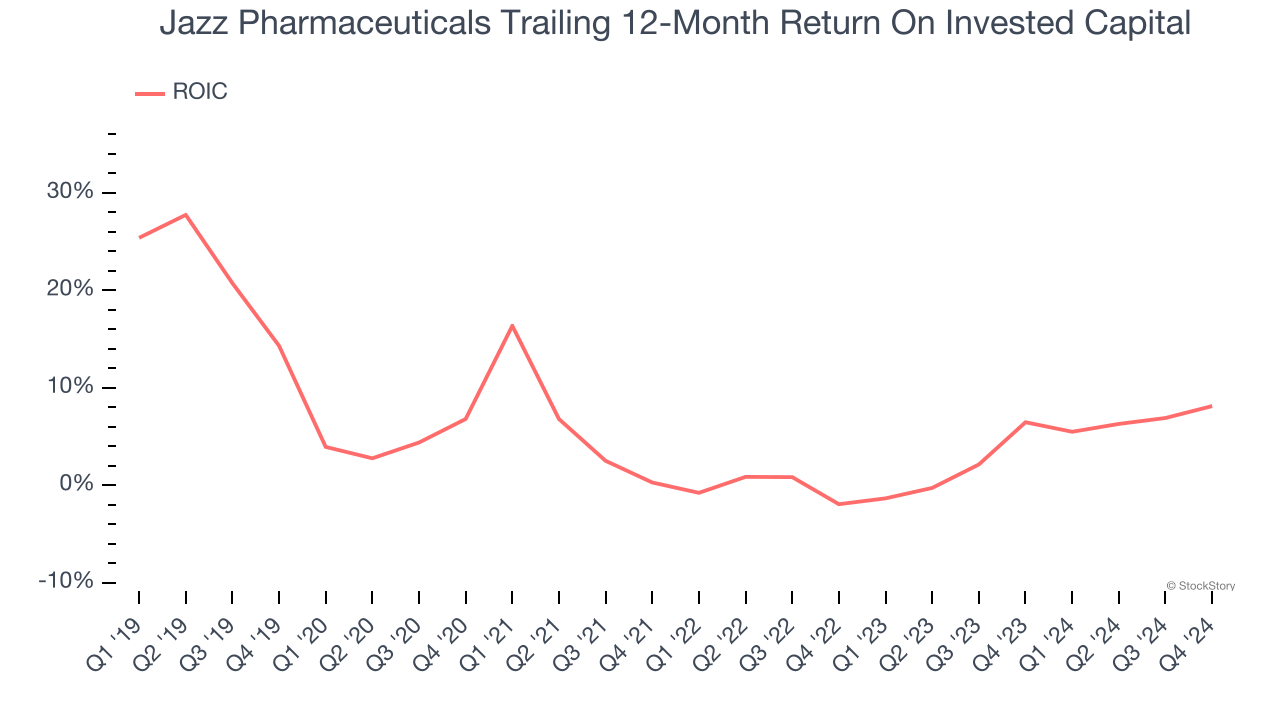

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Jazz Pharmaceuticals historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.9%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

Final Judgment

Jazz Pharmaceuticals isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 5× forward price-to-earnings (or $109.85 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Jazz Pharmaceuticals

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.