Academic publishing company John Wiley & Sons (NYSE:WLY) announced better-than-expected revenue in Q4 CY2024, but sales fell by 12.2% year on year to $404.6 million. The company expects the full year’s revenue to be around $1.67 billion, close to analysts’ estimates. Its non-GAAP profit of $0.84 per share was 86.7% above analysts’ consensus estimates.

Is now the time to buy Wiley? Find out by accessing our full research report, it’s free.

Wiley (WLY) Q4 CY2024 Highlights:

- Revenue: $404.6 million vs analyst estimates of $401.1 million (12.2% year-on-year decline, 0.9% beat)

- Adjusted EPS: $0.84 vs analyst estimates of $0.45 (86.7% beat)

- Adjusted EBITDA: $93.88 million vs analyst estimates of $85 million (23.2% margin, 10.4% beat)

- The company reconfirmed its revenue guidance for the full year of $1.67 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $3.43 at the midpoint

- EBITDA guidance for the full year is $397.5 million at the midpoint, above analyst estimates of $393 million

- Operating Margin: 12.8%, up from 10.6% in the same quarter last year

- Free Cash Flow Margin: 30.1%, up from 19.7% in the same quarter last year

- Market Capitalization: $2.04 billion

Company Overview

Founded in 1807 as a small printing shop in lower Manhattan, John Wiley & Sons (NYSE:WLY) is a global academic publisher that provides research journals, books, digital courseware, and professional development resources to researchers, students, and professionals.

Traditional Media & Publishing

The sector faces structural headwinds from declining linear TV viewership, shifts in advertising spend toward digital platforms, and ongoing challenges in monetizing print and broadcast content. However, for companies that invest wisely, tailwinds can include AI, the power of which can result in more personalized content creation and more detailed audience analysis. These can create a flywheel of success where one feeds into the other. Still there are outstanding questions around AI-generated content oversight, and the regulatory framework around this could evolve in unseen ways over the next few years.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.70 billion in revenue over the past 12 months, Wiley is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

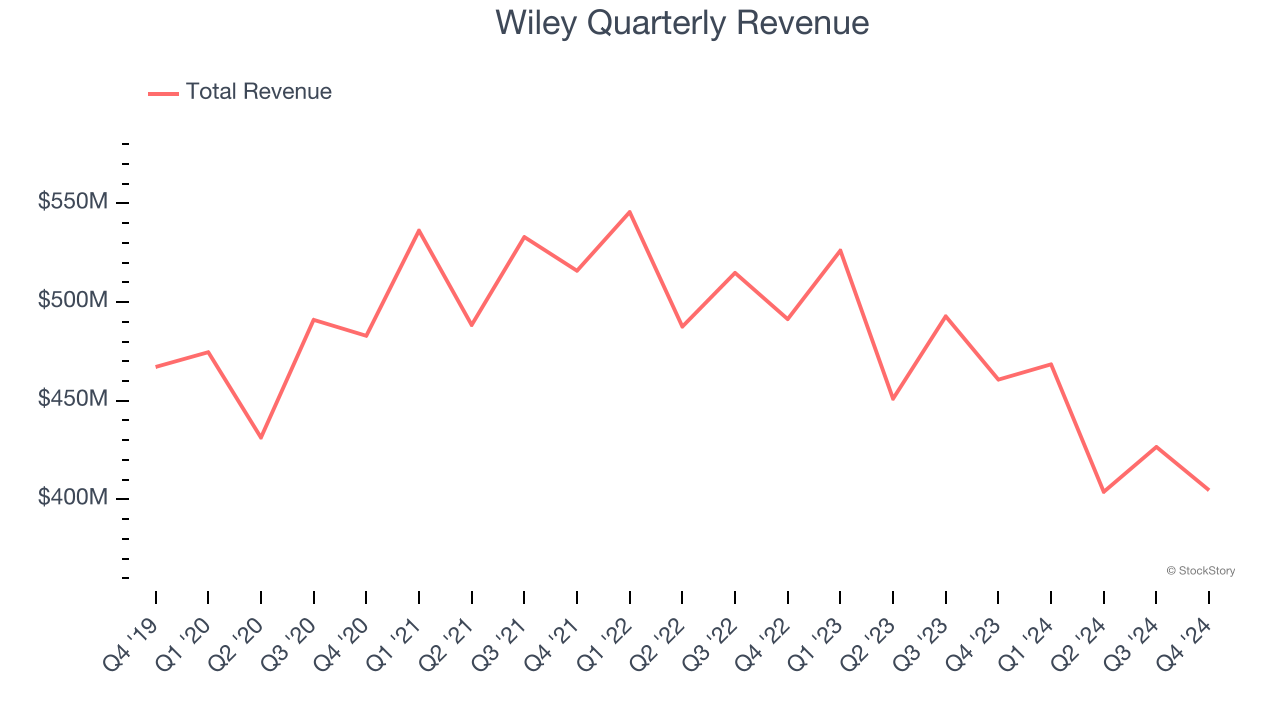

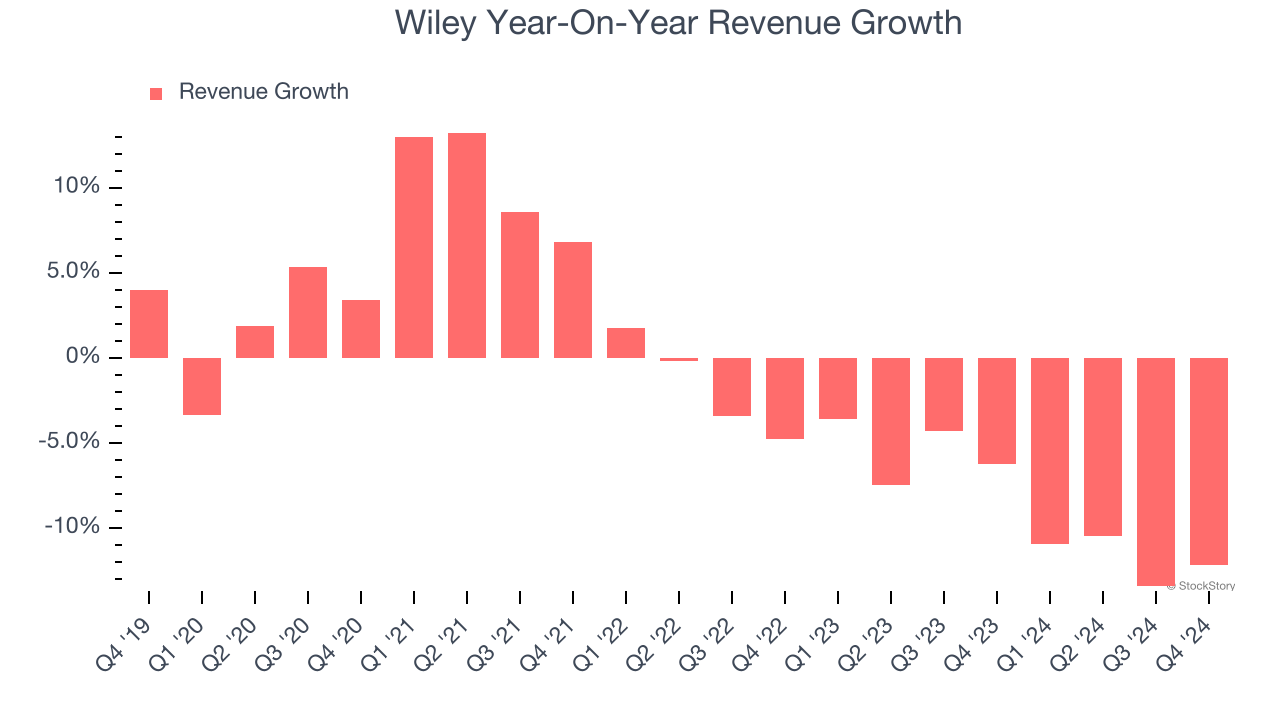

As you can see below, Wiley’s revenue declined by 1.6% per year over the last five years, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Wiley’s recent history shows its demand remained suppressed as its revenue has declined by 8.6% annually over the last two years.

This quarter, Wiley’s revenue fell by 12.2% year on year to $404.6 million but beat Wall Street’s estimates by 0.9%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

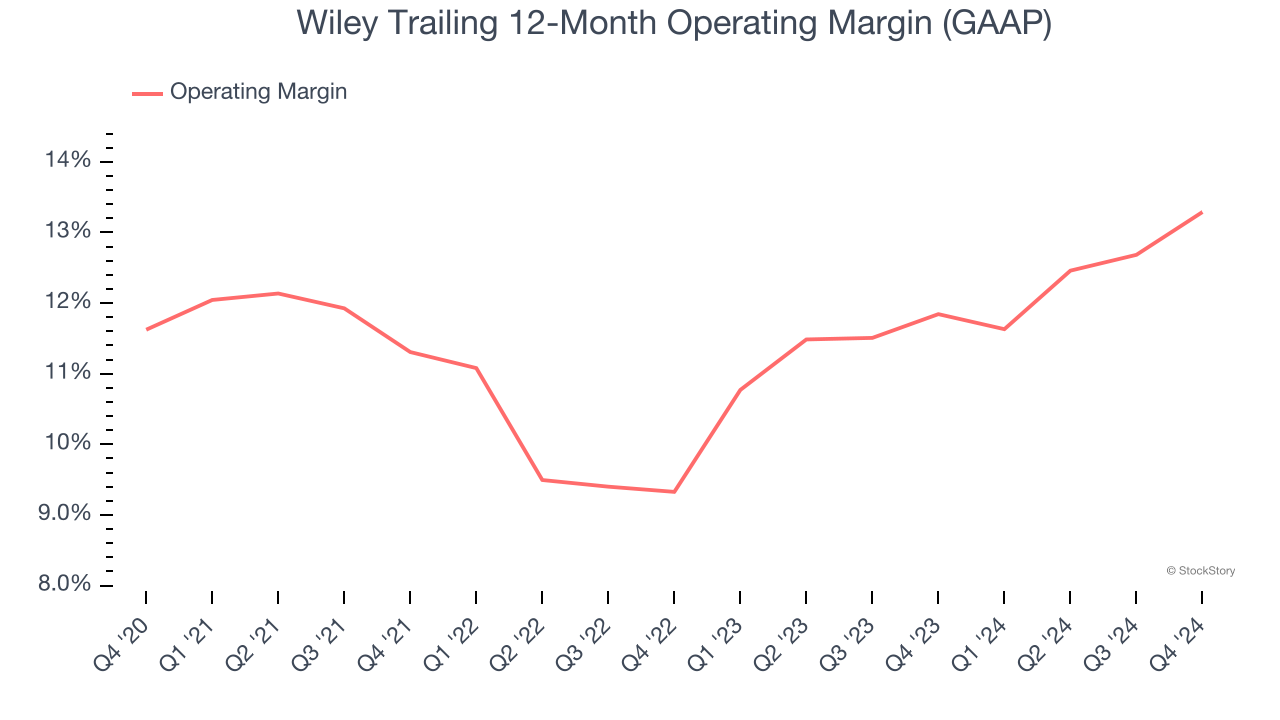

Wiley has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.4%, higher than the broader business services sector.

Looking at the trend in its profitability, Wiley’s operating margin rose by 1.7 percentage points over the last five years, showing its efficiency has improved.

This quarter, Wiley generated an operating profit margin of 12.8%, up 2.3 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was recently more efficient because it scaled down its expenses.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

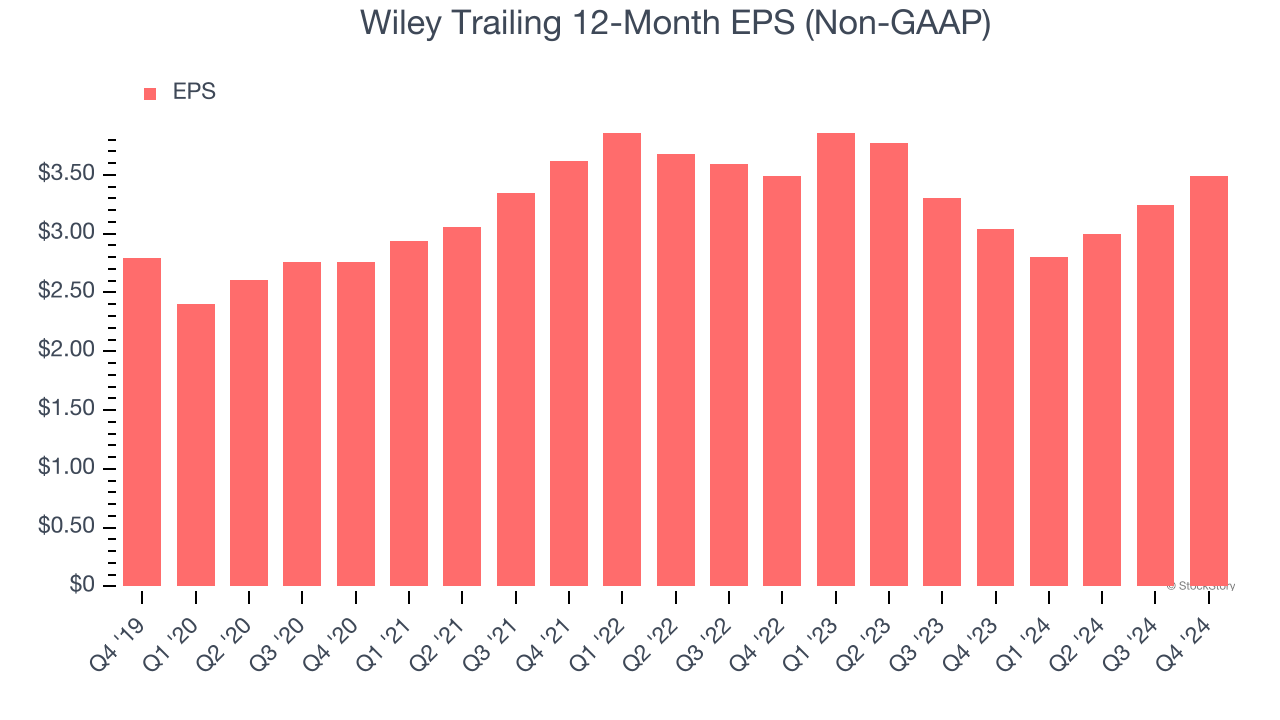

Wiley’s EPS grew at an unimpressive 4.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.6% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

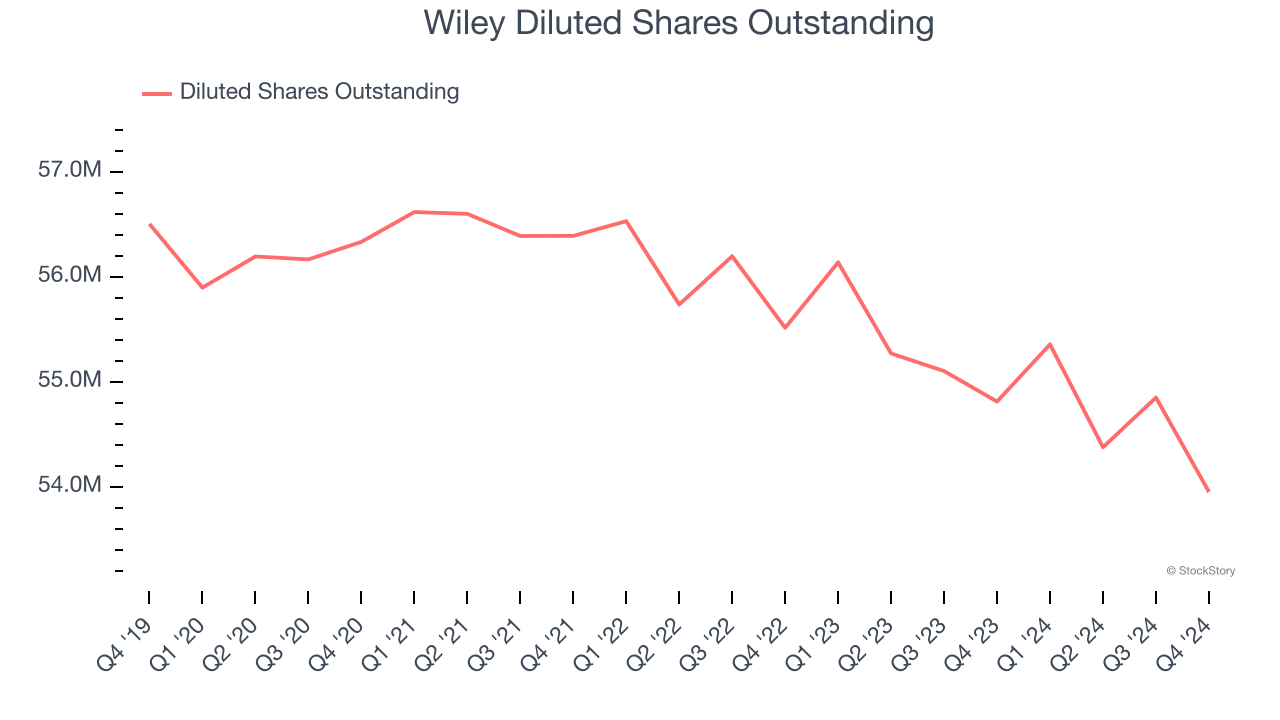

Diving into the nuances of Wiley’s earnings can give us a better understanding of its performance. As we mentioned earlier, Wiley’s operating margin expanded by 1.7 percentage points over the last five years. On top of that, its share count shrank by 4.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Wiley reported EPS at $0.84, up from $0.59 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Wiley’s Q4 Results

We were impressed by how significantly Wiley blew past analysts’ EPS and EBITDA expectations this quarter. We were also excited its full-year EPS and EBITDA guidance outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $43.70 immediately after reporting.

Is Wiley an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.