Healthcare services provider BrightSpring Health Services (NASDAQ:BTSG) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 28.6% year on year to $3.05 billion. The company expects the full year’s revenue to be around $11.85 billion, close to analysts’ estimates. Its non-GAAP profit of $0.22 per share was in line with analysts’ consensus estimates.

Is now the time to buy BrightSpring Health Services? Find out by accessing our full research report, it’s free.

BrightSpring Health Services (BTSG) Q4 CY2024 Highlights:

- Revenue: $3.05 billion vs analyst estimates of $3.02 billion (28.6% year-on-year growth, 1.1% beat)

- Adjusted EPS: $0.22 vs analyst estimates of $0.21 (in line)

- Adjusted EBITDA: $167.4 million vs analyst estimates of $166.8 million (5.5% margin, in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $11.85 billion at the midpoint, in line with analyst expectations and implying 5.2% growth (vs 27.6% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $552.5 million at the midpoint, below analyst estimates of $566.3 million

- Operating Margin: 2.6%, in line with the same quarter last year

- Free Cash Flow Margin: 2.5%, down from 6.1% in the same quarter last year

- Market Capitalization: $3.20 billion

“In 2024, BrightSpring’s focus on quality and third-party satisfaction scores, growth in customers and patients served, and efficiency and best practices across the organization resulted in another excellent year of both operational and financial performance,” said Jon Rousseau, Chairman, President and Chief Executive Officer of the Company.

Company Overview

Founded in 1974, BrightSpring Health Services (NASDAQ:BTSG) offers home health care, hospice, neuro-rehabilitation, and pharmacy services.

Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

Sales Growth

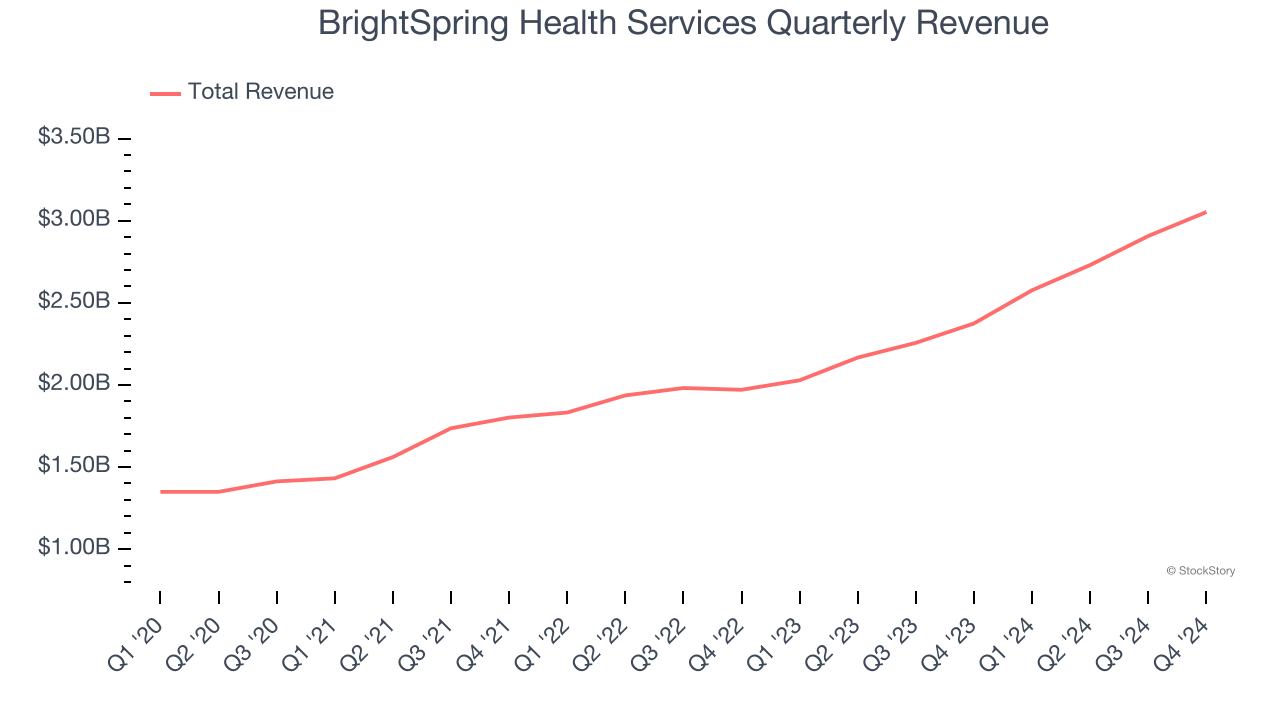

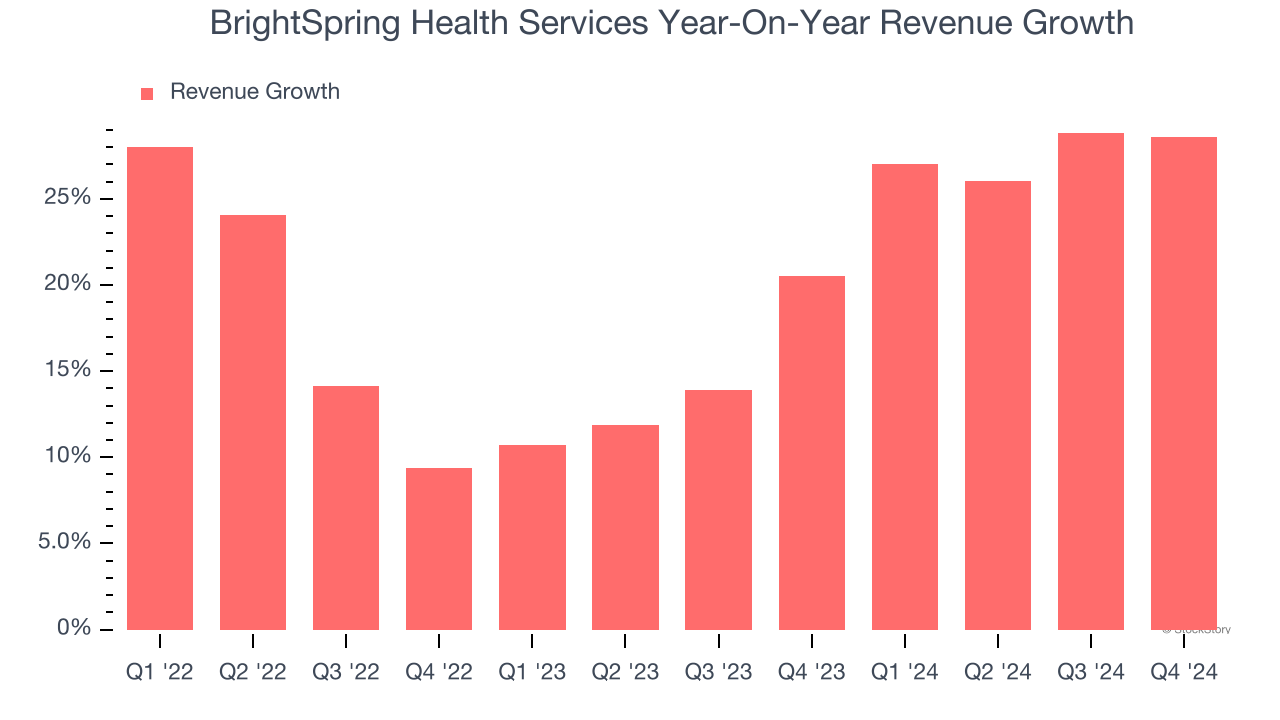

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, BrightSpring Health Services’s 19.9% annualized revenue growth over the last three years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. BrightSpring Health Services’s annualized revenue growth of 20.8% over the last two years aligns with its three-year trend, suggesting its demand was predictably strong.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Pharmacy. Over the last two years, BrightSpring Health Services’s Pharmacy revenue averaged 29% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, BrightSpring Health Services reported robust year-on-year revenue growth of 28.6%, and its $3.05 billion of revenue topped Wall Street estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and indicates the market is baking in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

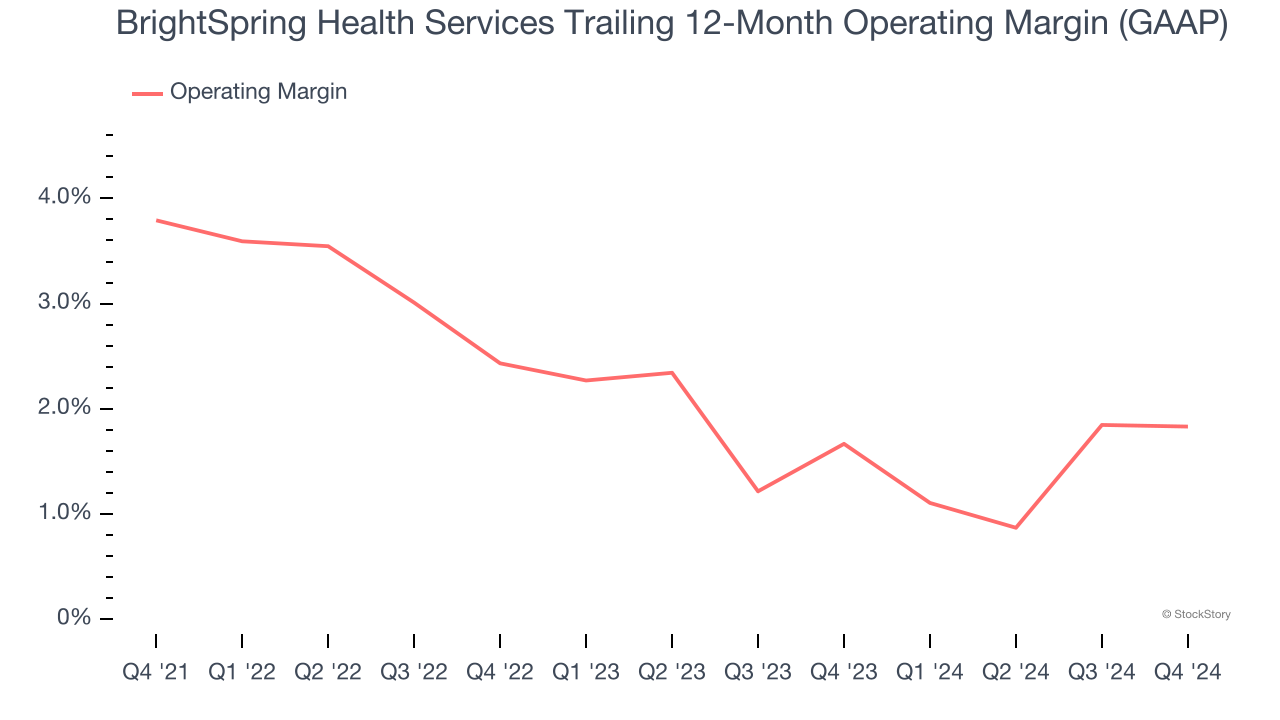

BrightSpring Health Services was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.4% was weak for a healthcare business.

Looking at the trend in its profitability, BrightSpring Health Services’s operating margin decreased by 1.8 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. Still, shareholders will want to see BrightSpring Health Services become more profitable in the future.

In Q4, BrightSpring Health Services generated an operating profit margin of 2.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

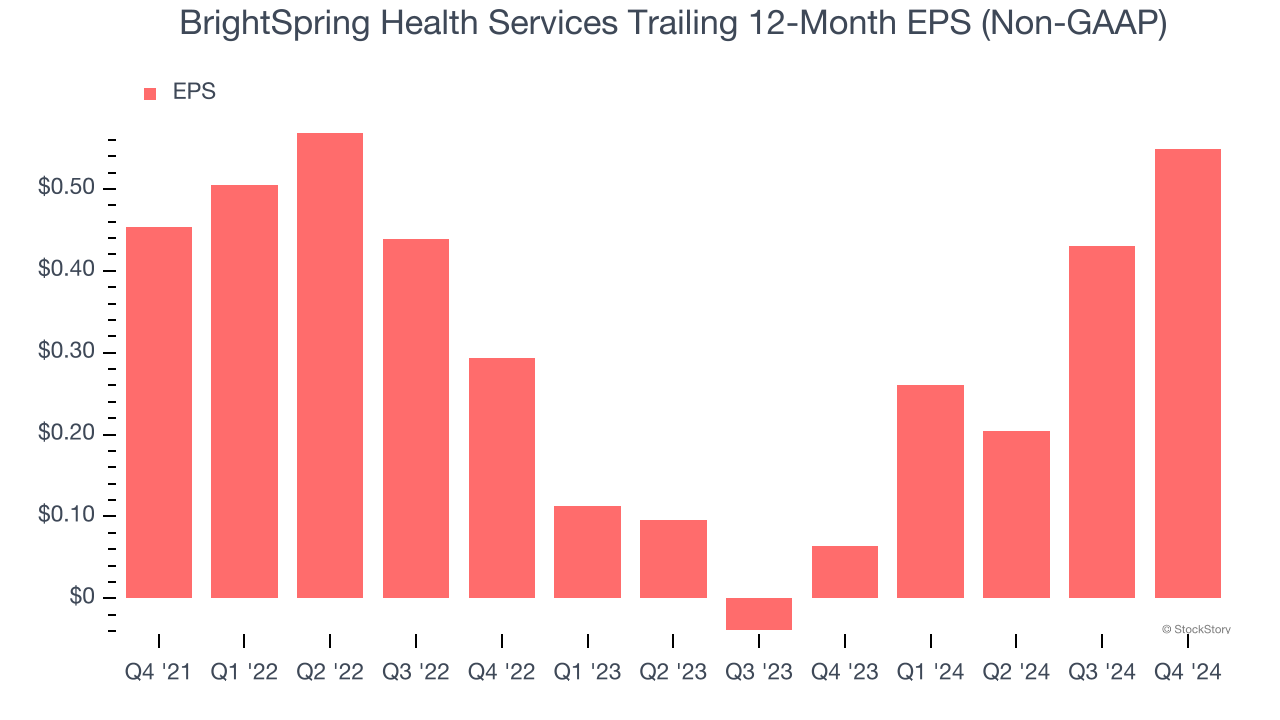

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

BrightSpring Health Services’s EPS grew at a decent 6.5% compounded annual growth rate over the last three years. However, this performance was lower than its 19.9% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

In Q4, BrightSpring Health Services reported EPS at $0.22, up from $0.10 in the same quarter last year. This print beat analysts’ estimates by 3.8%. Over the next 12 months, Wall Street expects BrightSpring Health Services’s full-year EPS of $0.55 to shrink by 3%.

Key Takeaways from BrightSpring Health Services’s Q4 Results

It was good to see BrightSpring Health Services narrowly top analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its full-year revenue guidance was in line with Wall Street’s estimates. Overall, this quarter was mixed. The stock remained flat at $18.50 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.