Grid Dynamics has had an impressive run over the past six months as its shares have beaten the S&P 500 by 23.6%. The stock now trades at $18.60, marking a 27.4% gain. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is GDYN a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does GDYN Stock Spark Debate?

Founded during the early days of cloud computing in 2006, Grid Dynamics (NASDAQ:GDYN) is a technology consulting firm that helps large enterprises modernize their operations through cloud computing, artificial intelligence, and digital engineering services.

Two Positive Attributes:

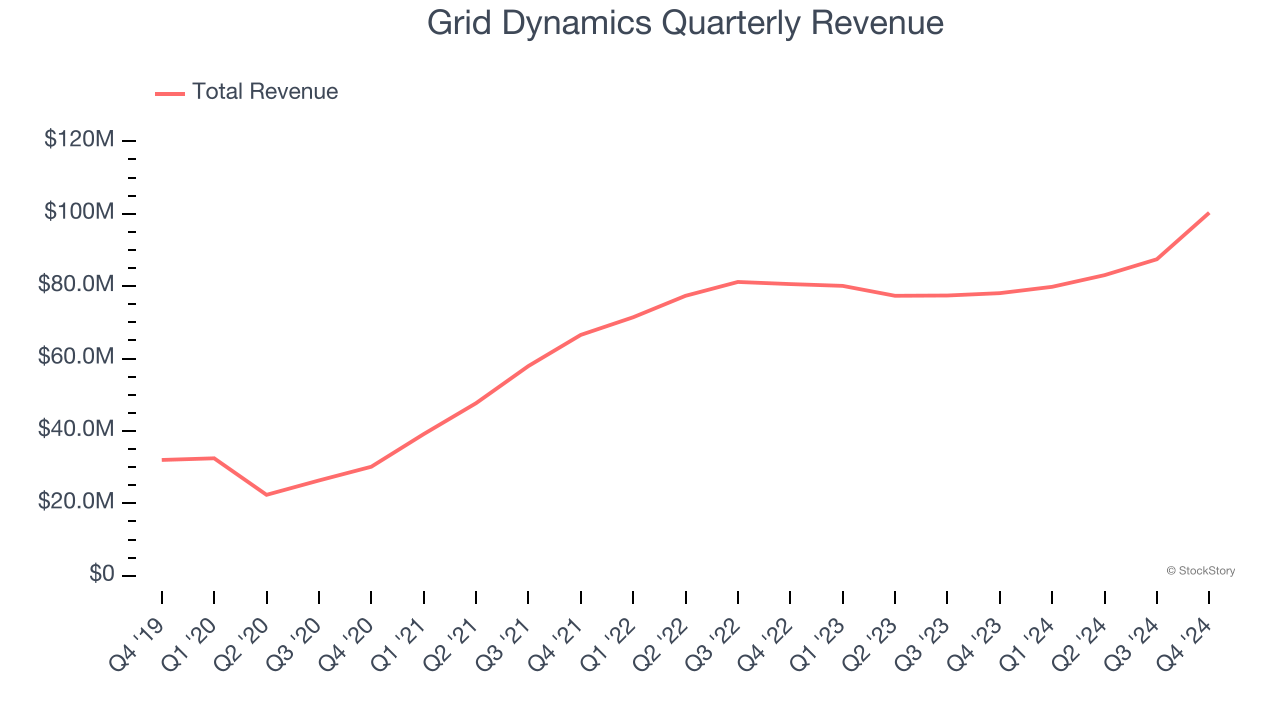

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Grid Dynamics’s 24.3% annualized revenue growth over the last five years was incredible. Its growth beat the average business services company and shows its offerings resonate with customers.

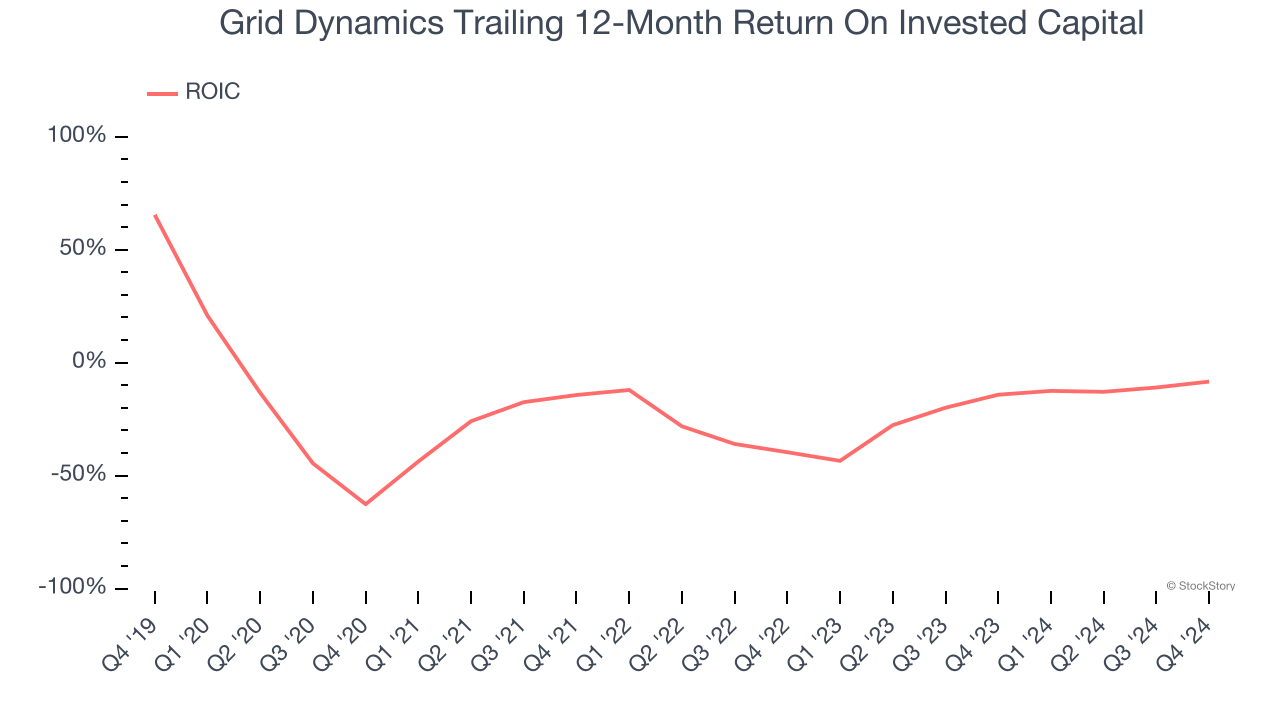

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Grid Dynamics’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

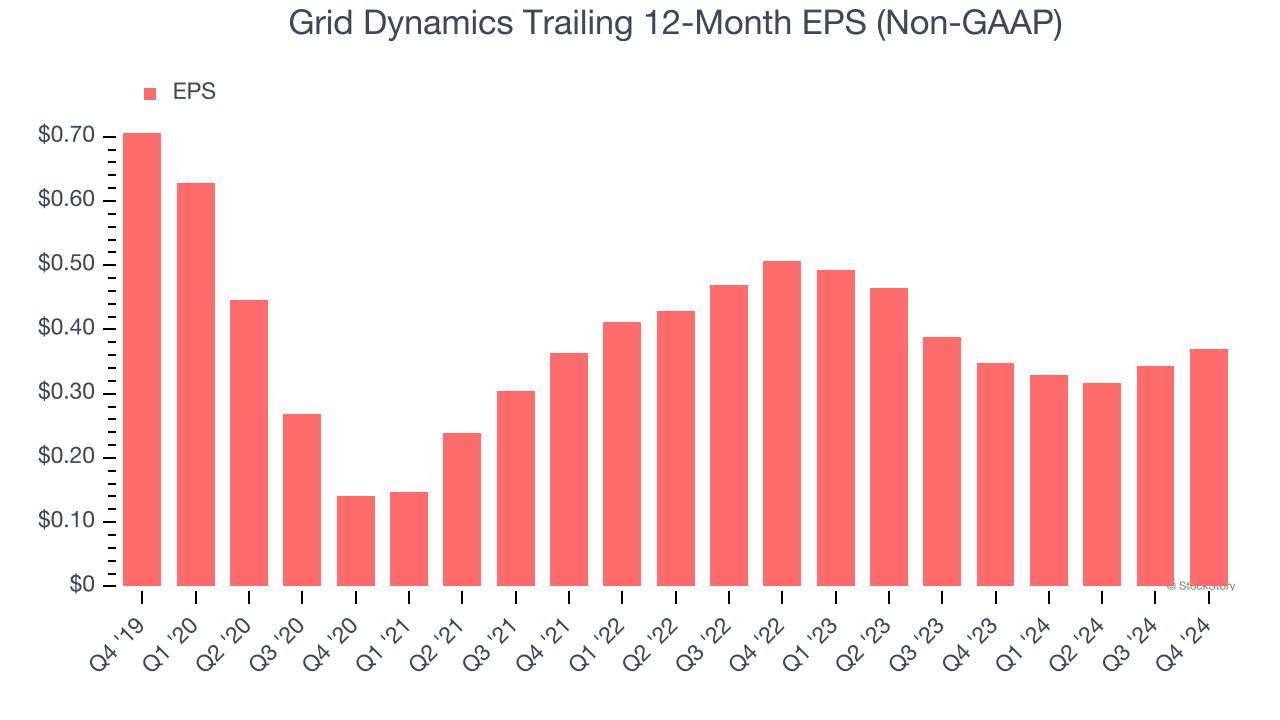

EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Grid Dynamics, its EPS declined by 12.2% annually over the last five years while its revenue grew by 24.3%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Grid Dynamics’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 44.8× forward price-to-earnings (or $18.60 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Grid Dynamics

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.