Since March 2020, the S&P 500 has delivered a total return of 97.5%. But one standout stock has nearly doubled the market - over the past five years, Boston Scientific has surged 176% to $97 per share. Its momentum hasn’t stopped as it’s also gained 16.8% in the last six months thanks to its solid quarterly results, beating the S&P by 13%.

Is now still a good time to buy BSX? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does BSX Stock Spark Debate?

Founded in 1979, Boston Scientific (NYSE:BSX) is a medical device company that designs, manufactures, and sells a wide range of technologies used in minimally-invasive medical procedures.

Two Positive Attributes:

1. Core Business Firing on All Cylinders

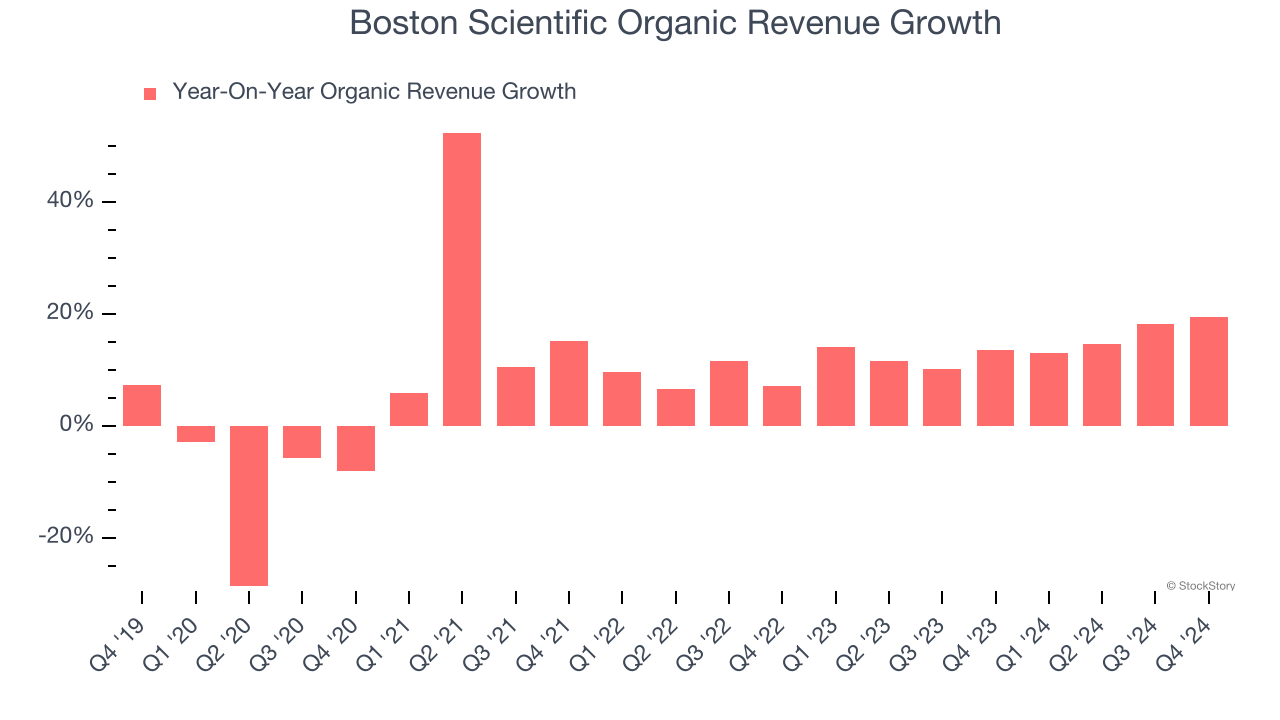

We can better understand Medical Devices & Supplies - Diversified companies by analyzing their organic revenue. This metric gives visibility into Boston Scientific’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Boston Scientific’s organic revenue averaged 14.4% year-on-year growth. This performance was impressive and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Increasing Free Cash Flow Margin Juices Financials

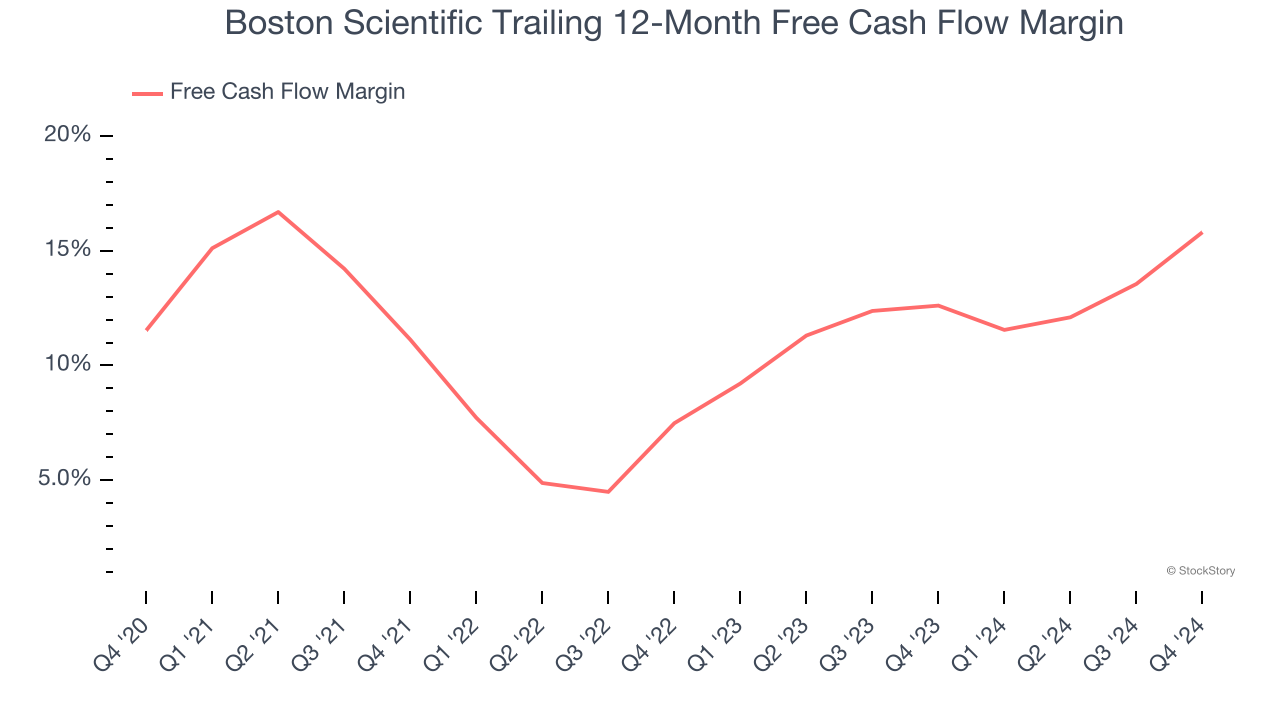

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Boston Scientific’s margin expanded by 4.3 percentage points over the last five years. This is encouraging because it gives the company more optionality. Boston Scientific’s free cash flow margin for the trailing 12 months was 15.8%.

One Reason to be Careful:

Previous Growth Initiatives Haven’t Impressed

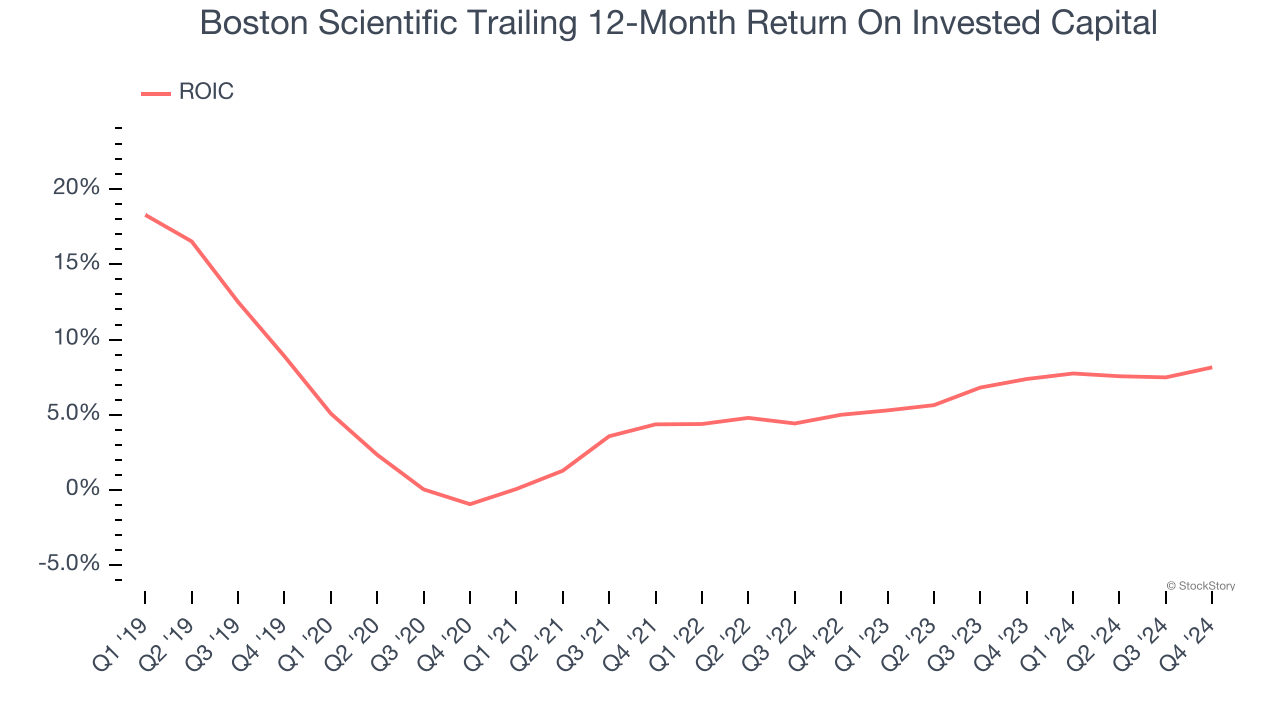

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Boston Scientific has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.8%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

Final Judgment

Boston Scientific’s positive characteristics outweigh the negatives, and with its shares outperforming the market lately, the stock trades at 35.3× forward price-to-earnings (or $97 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Boston Scientific

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.