Live sports and TV streaming service fuboTV (NYSE:FUBO) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 8.1% year on year to $443.3 million. On the other hand, next quarter’s revenue guidance of $413 million was less impressive, coming in 6.2% below analysts’ estimates. Its non-GAAP loss of $0.02 per share was 82.4% above analysts’ consensus estimates.

Is now the time to buy fuboTV? Find out by accessing our full research report, it’s free.

fuboTV (FUBO) Q4 CY2024 Highlights:

- Revenue: $443.3 million vs analyst estimates of $444.6 million (8.1% year-on-year growth, in line)

- Adjusted EPS: -$0.02 vs analyst estimates of -$0.11 (82.4% beat)

- Adjusted EBITDA: -$8.70 million vs analyst estimates of -$32.51 million (-2% margin, 73.2% beat)

- Revenue Guidance for Q1 CY2025 is $413 million at the midpoint, below analyst estimates of $440.2 million

- Operating Margin: -8.7%, up from -17.6% in the same quarter last year

- Free Cash Flow was $17.37 million, up from -$5.85 million in the same quarter last year

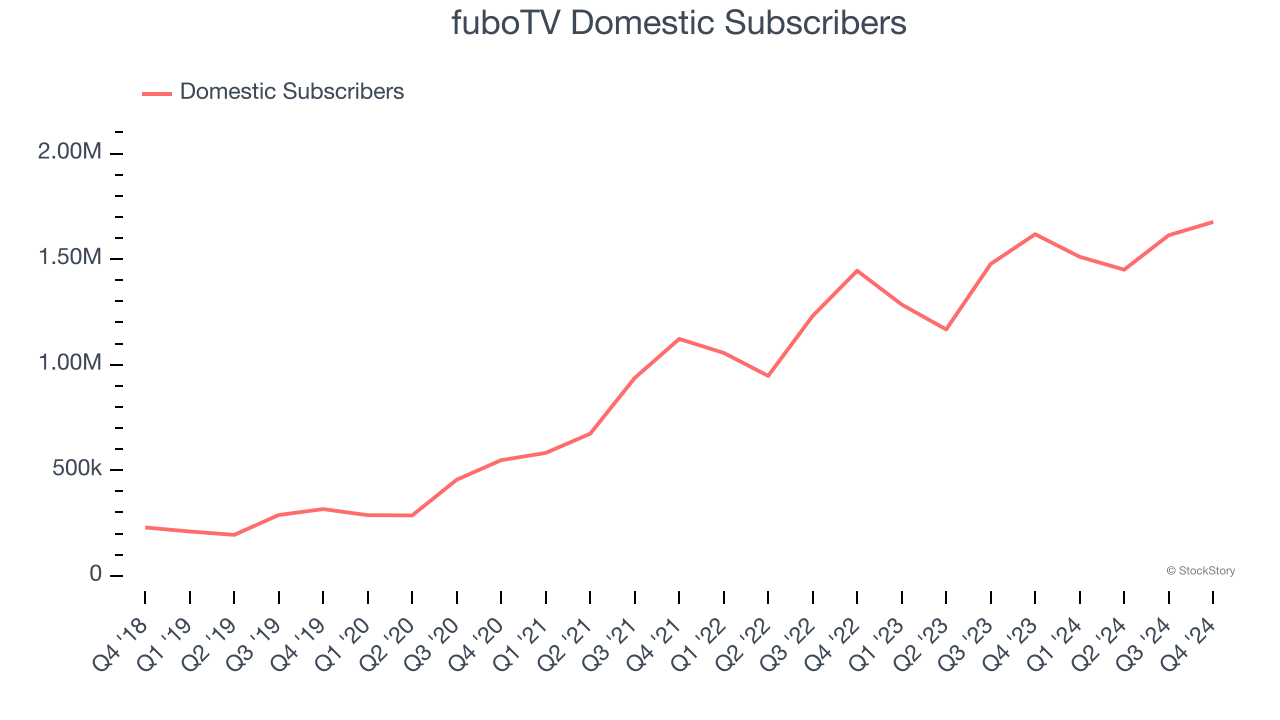

- Domestic Subscribers: 1.68 million, up 58,000 year on year

- Market Capitalization: $1.19 billion

Company Overview

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

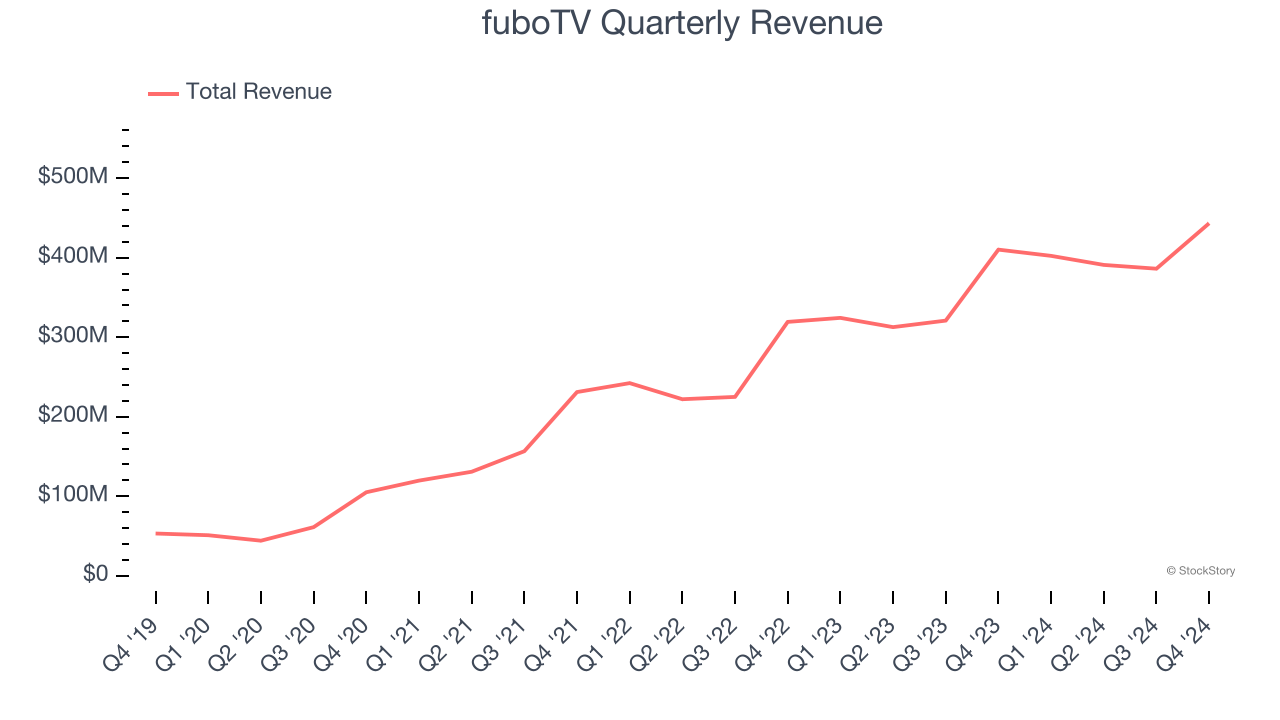

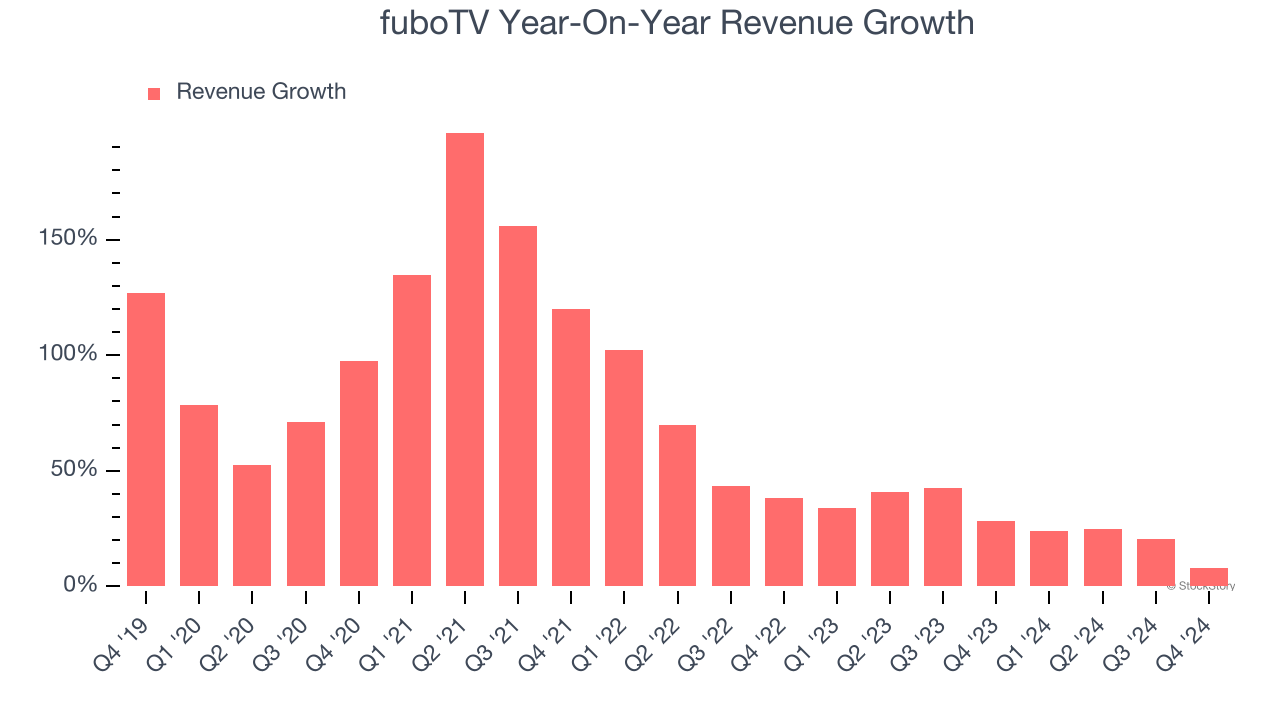

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, fuboTV grew its sales at an incredible 61.8% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. fuboTV’s annualized revenue growth of 26.8% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

We can better understand the company’s revenue dynamics by analyzing its number of domestic subscribers and international subscribers, which clocked in at 1.68 million and 362,000 in the latest quarter. Over the last two years, fuboTV’s domestic subscribers averaged 16.4% year-on-year growth while its international subscribers averaged 4.6% year-on-year growth.

This quarter, fuboTV grew its revenue by 8.1% year on year, and its $443.3 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 2.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

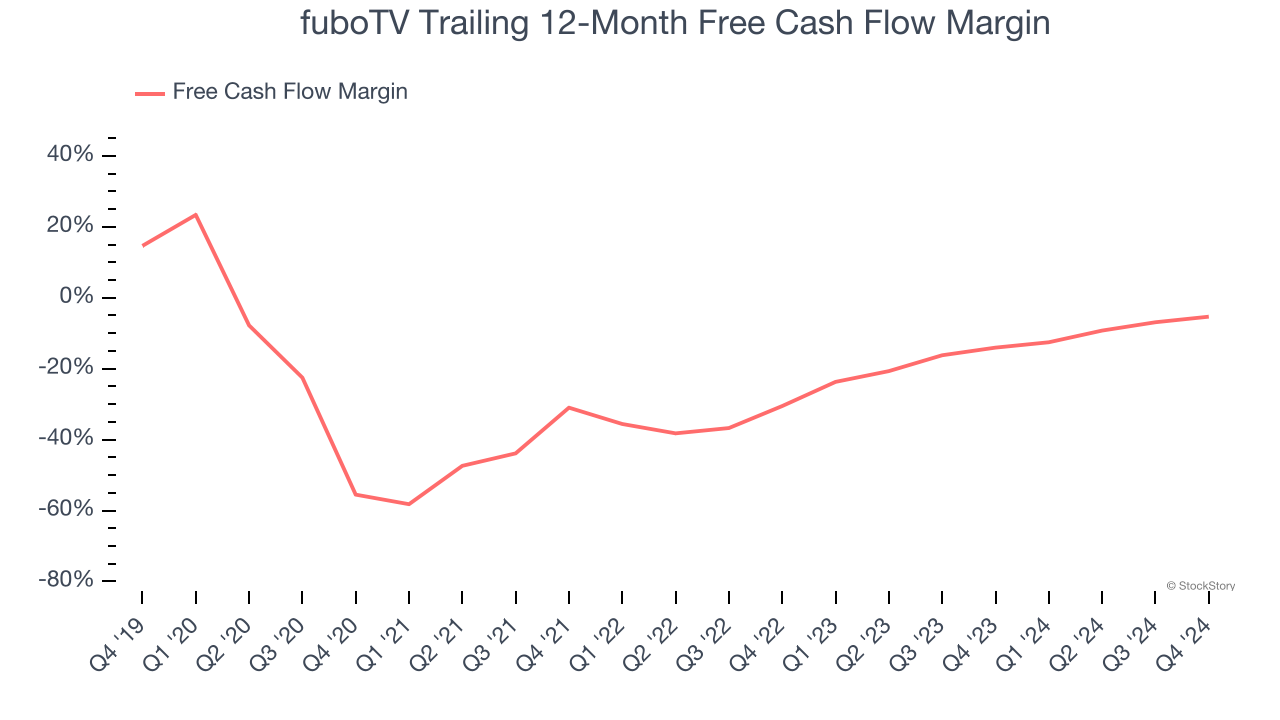

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While fuboTV posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, fuboTV’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.3%, meaning it lit $9.32 of cash on fire for every $100 in revenue.

fuboTV’s free cash flow clocked in at $17.37 million in Q4, equivalent to a 3.9% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict fuboTV’s cash conversion will improve to break even. Their consensus estimates imply its free cash flow margin of negative 5.3% for the last 12 months will increase by 5.9 percentage points.

Key Takeaways from fuboTV’s Q4 Results

We were impressed by how significantly fuboTV blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue guidance for next quarter missed and its number of international subscribers fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock traded up 1.8% to $3.60 immediately following the results.

Indeed, fuboTV had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.