AerSale currently trades at $6.36 per share and has shown little upside over the past six months, posting a small loss of 2.5%. The stock also fell short of the S&P 500’s 10% gain during that period.

Is there a buying opportunity in AerSale, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're cautious about AerSale. Here are three reasons why we avoid ASLE and a stock we'd rather own.

Why Do We Think AerSale Will Underperform?

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ:ASLE) delivers full-service support to mid-life commercial aircraft.

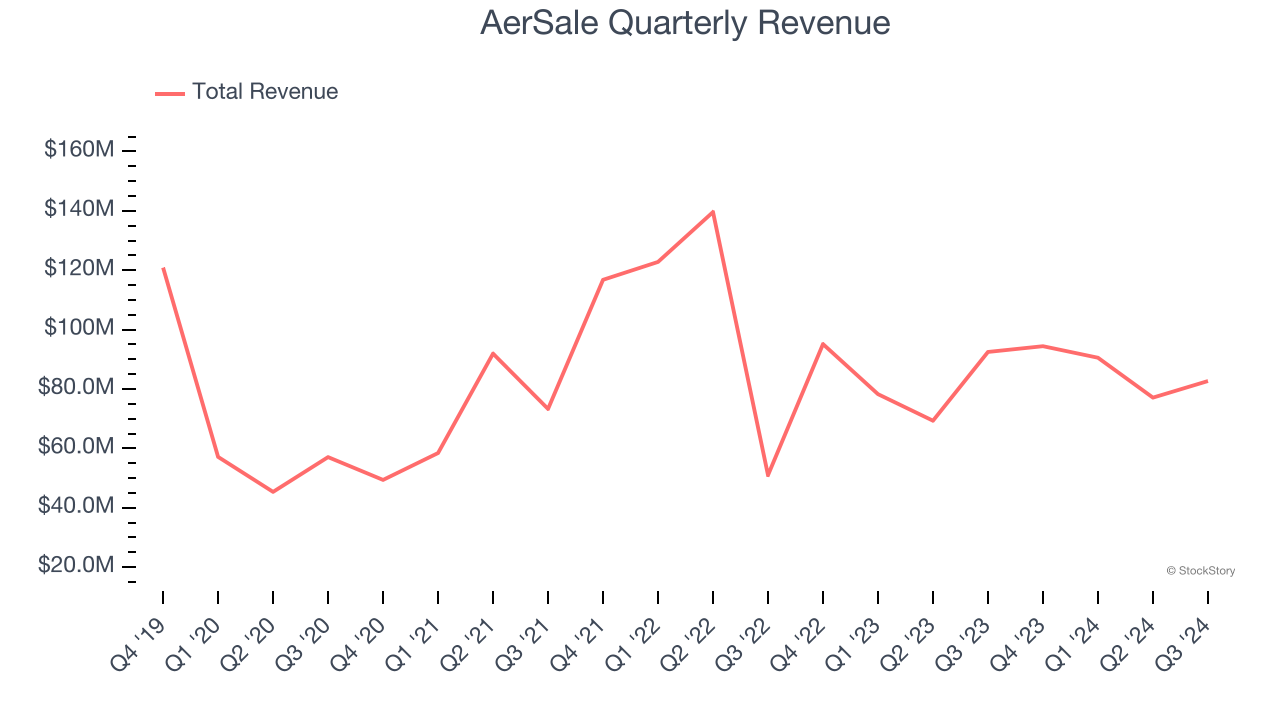

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, AerSale’s sales grew at a tepid 5.3% compounded annual growth rate over the last four years. This was below our standard for the industrials sector.

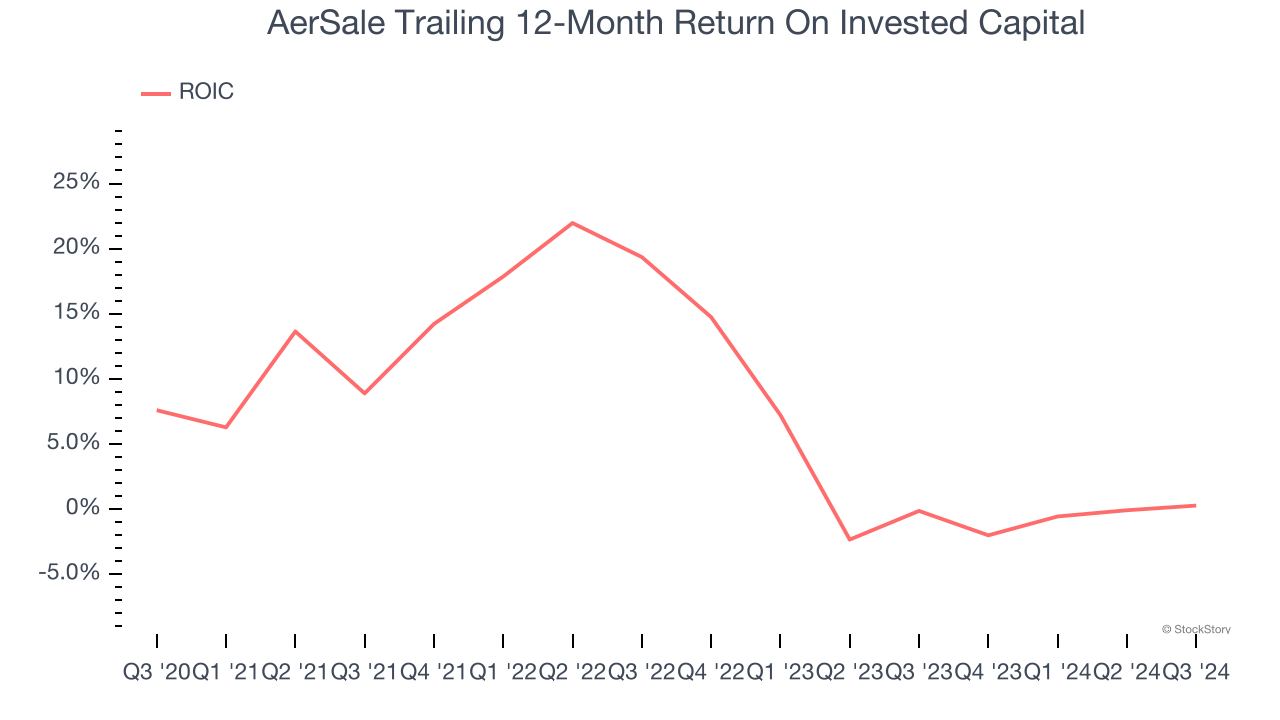

2. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, AerSale’s ROIC has decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

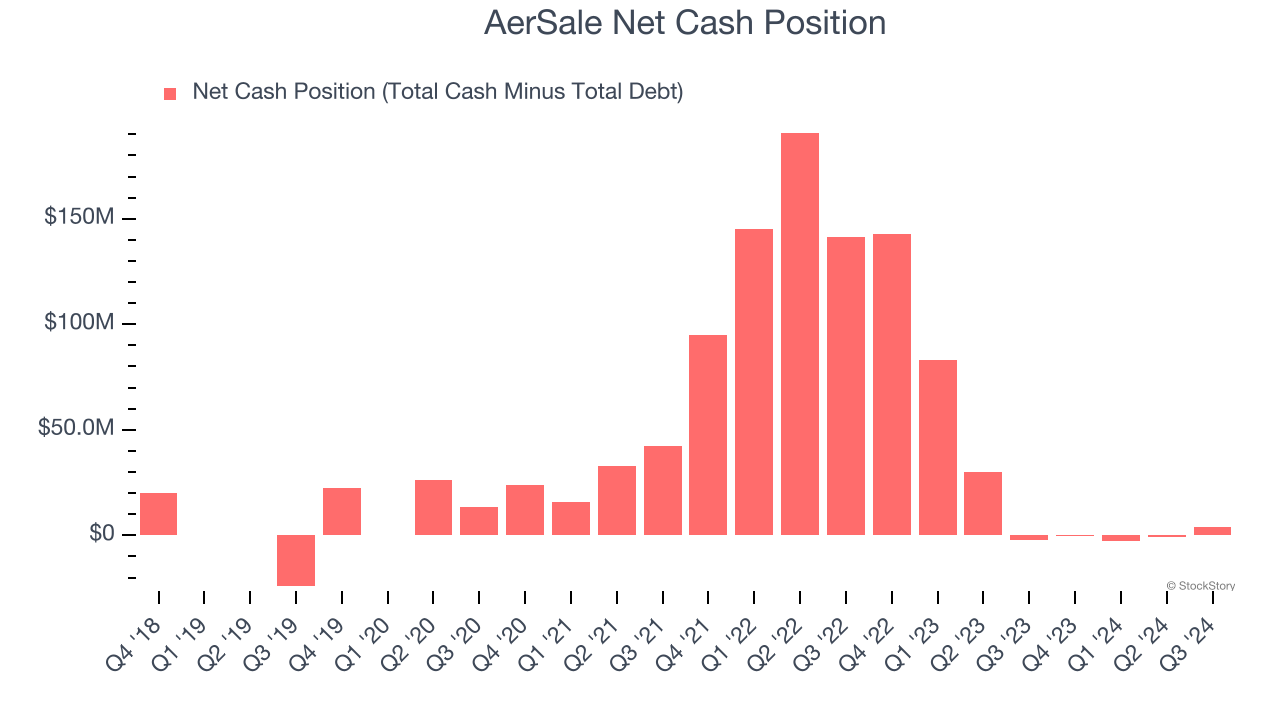

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

AerSale burned through $44.81 million of cash over the last year. With $9.79 million of cash on its balance sheet, the company has around 3 months of runway left (assuming its $5.79 million of debt isn’t due right away).

Unless the AerSale’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of AerSale until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

AerSale falls short of our quality standards. With its shares underperforming the market lately, the stock trades at 12.3× forward price-to-earnings (or $6.36 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere. We’d suggest looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than AerSale

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.