Akron, Ohio-based FirstEnergy Corp. (FE) is a regulated electric utility company that generates, transmits, and distributes electricity across the United States. Valued at a market cap of $26.5 billion, the company operates an extensive infrastructure network and is committed to delivering safe, reliable power while investing in grid modernization and clean energy initiatives.

This utility company has lagged behind the broader market over the past 52 weeks. Shares of FE have gained 11.1% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14%. Moreover, on a YTD basis, the stock is up 16%, compared to SPX’s 16.2% uptick.

Narrowing the focus, FE has also underperformed the Utilities Select Sector SPDR Fund’s (XLU) 13.2% return over the past 52 weeks and 18.5% YTD rise.

FE delivered better-than-expected Q3 earnings results on Oct. 22, yet its shares plunged 1.6% in the following trading session. The company’s core earnings of $0.83 increased 9.2% from the year-ago quarter, surpassing analyst expectations of $0.76. Additionally, it raised and narrowed its fiscal 2025 core earnings guidance in the range of $2.50 to $2.56 per share and affirmed its 6% to 8% compounded annual core earnings growth rate target from 2025 through 2029.

For the current fiscal year, ending in December, analysts expect FE’s EPS to decline 3.8% year over year to $2.53. The company’s earnings surprise history is mixed. It exceeded consensus estimates in three of the last four quarters, while missing the mark on another occasion.

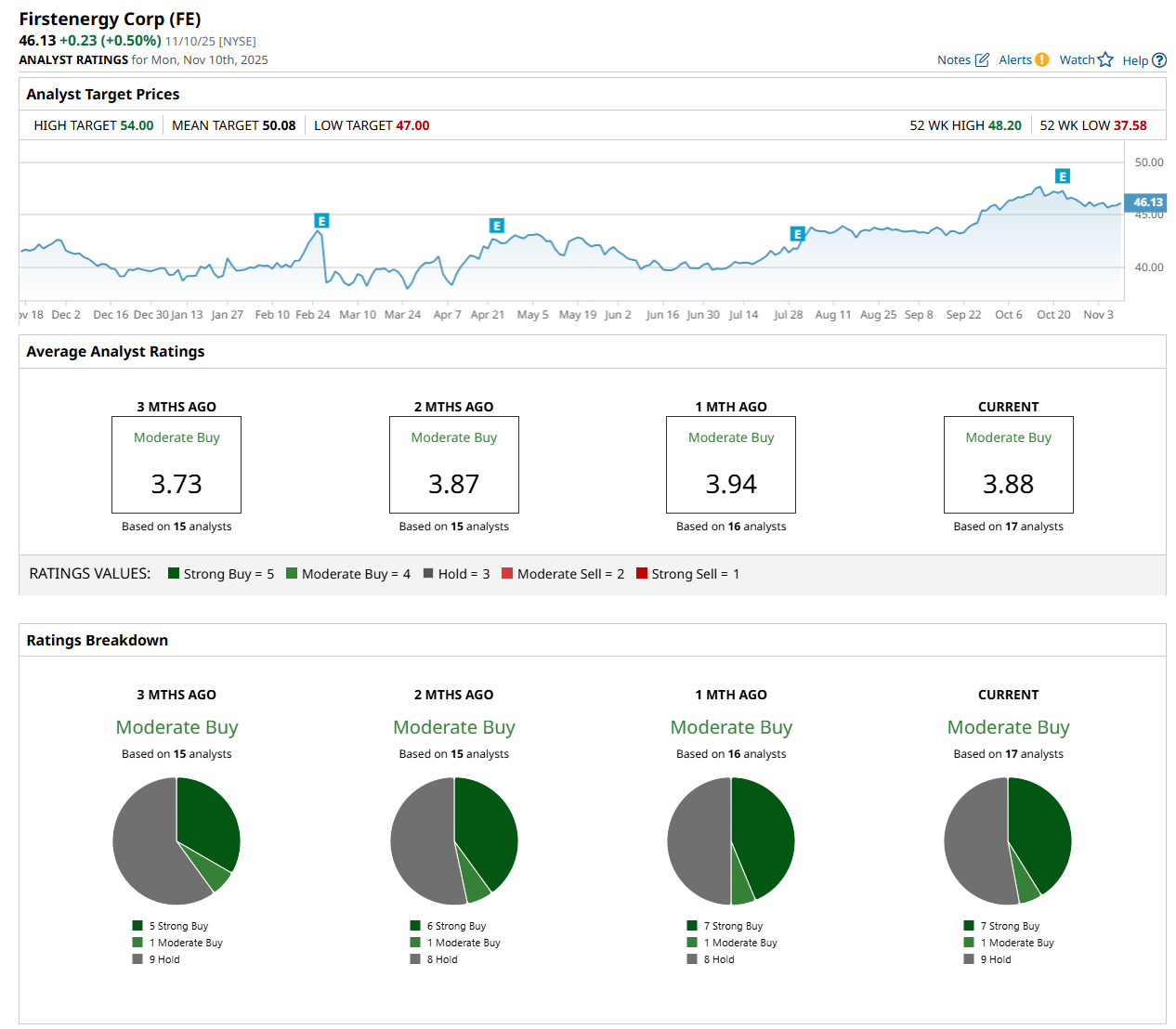

Among the 17 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” one "Moderate Buy,” and nine "Hold” ratings.

This configuration is slightly more bullish than two months ago, with six analysts suggesting a “Strong Buy” rating.

On Oct. 27, Wells Fargo & Company (WFC) analyst Shahriar Pourreza initiated coverage of FirstEnergy with an “Overweight” rating and $54 price target, the Street-high price target, indicating a 17.1% potential upside from the current levels.

The mean price target of $50.08 represents an 8.6% premium from FE’s current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart