The market had barely begun to catch its breath when GitLab (GTLB) decided to steal the spotlight last month on Oct. 16. The stock lit up the screens of traders, shooting up nearly 11% just as the closing bell neared. The broader market, meanwhile, looked like it had lost its appetite for risk, with the S&P 500 Index ($SPX) slipping 0.6%.

The spark behind the sudden blaze was a Street Insider post that sent the rumor mill spinning, hinting that Datadog (DDOG) might be circling GitLab again. A source claimed that Datadog’s management was weighing an offer north of $60 per share, a 30% premium over GTLB stock's current price level. Adding more spice to the mix, the report mentioned that Datadog was working with Morgan Stanley to get its financial ducks in a row.

This is not the first time GitLab has been in the takeover spotlight. Back in July 2024, word spread that GitLab was exploring a sale after drawing strong acquisition interest.

Is it just smoke again this time? Or is there a real fire brewing with GTLB stock? Let's take a closer look.

About GitLab Stock

Headquartered in San Francisco, California, GitLab has built itself into the invisible backbone of how modern software takes shape. With a market capitalization circling $7.6 billion, GitLab offers its DevSecOps Platform built on a single codebase, a unified data model, and one seamless interface.

It helps organizations code faster, operate smarter, and stay a step ahead of security chaos while speeding through digital transformation. Its offerings come neatly stacked in three tiers: Free, Premium, and Ultimate. Beyond that, GitLab extends its touch through professional training, SaaS products, and ongoing support that keeps development engines humming.

Still, 2025 has tested its mettle. GTLB stock has fallen 199% year-to-date (YTD) and slipped 24% over the past 52 weeks. It's now hovering 39% below its January high of $74.18.

Still, as seasoned investors often say, sometimes opportunity hides in plain sight. Currently, GTLB stock trades at 10 times forward sales. Its valuation stands higher compared to the broader industry average. But then again, quality never goes on sale.

GitLab Surpasses Q2 Earnings

On Sept. 3, GitLab dropped its second-quarter fiscal 2026 results. Revenue surged 29% year-over-year (YOY) to $236 million, cruising past the consensus estimate for the quarter ended July 31. Non-GAAP EPS landed at $0.24, a 60% climb from the year-ago figure and again above Wall Street’s expectations.

The real charm was in the cash, however. The company churned out $49.4 million in operating cash flow and $46.5 million in non-GAAP adjusted free cash flow. Those figures were 322% and 328% ahead of last year, respectively.

Customer momentum fired on all cylinders. Accounts bringing in over $5,000 in annual recurring revenue (ARR) rose 11% to 10,338. Those contributing over $100,000 jumped 25% to 1,344. The dollar-based net retention rate held a sturdy 121%, while total remaining performance obligations shot up 32% to $988.2 million.

Artificial intelligence (AI) dominated GitLab’s second quarter. It positioned the Duo Agent Platform as a standout differentiator in the AI battleground, setting the tone for its next growth phase. The Duo Agent Platform will launch with a customizable pricing structure.

Customers will get some usage included in their standard subscriptions, with flexible options to pay as they go or pre-commit for better pricing. GitLab also strengthened its AI ecosystem through strategic collaborations with Google (GOOGL), Amazon (AMZN), Anthropic, and Cursor, partnering with the tech elite to anchor its position in the rapidly evolving AI economy.

Looking ahead, the company reaffirmed its full-year fiscal 2026 revenue outlook at $936 million to $942 million and bumped up its non-GAAP EPS guidance to between $0.82 and $0.83. For Q3, GitLab expects revenue between $238 million and $239 million, non-GAAP operating income of $31 million to $32 million, and EPS of $0.19 to $0.20.

Analysts, meanwhile, see the Q3 2026 loss per share narrowing 17% YOY to $0.05. For fiscal 2026, they project a wider loss per share of $0.19, up 27%, before tightening again by 10% in fiscal 2027 to $0.17.

What Do Analysts Expect for GitLab Stock?

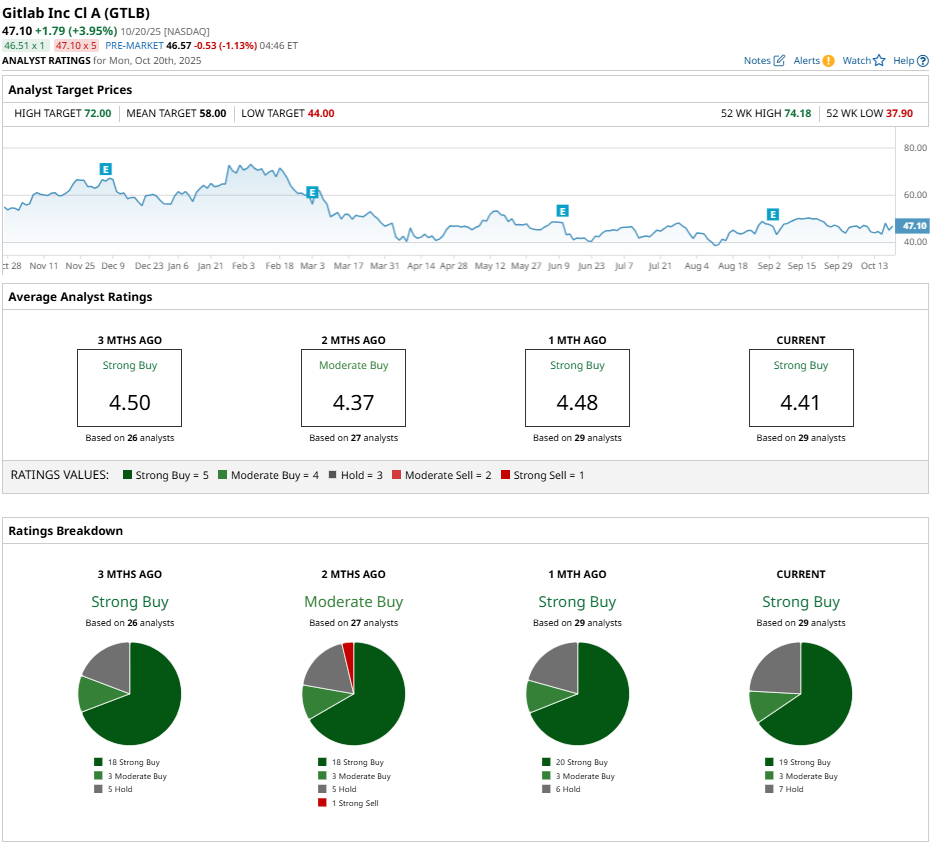

Analysts following GitLab seem to be singing from the same bullish hymn sheet, keeping their outlook firmly optimistic. The stock currently holds a consensus rating of “Strong Buy,” a sign of growing confidence in its momentum. Out of 29 analysts, 19 recommend a “Strong Buy,” three call it a “Moderate Buy,” and seven provide a “Hold" rating.

GTLB stock's average price target of $58 represents potential upside of 29% from here. Meanwhile, the Street-high target of $72 suggests room for a potential gain of 60% from current levels. In a market where conviction often wavers, GitLab seems to be holding analysts’ attention with both hands.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 2 Stocks Are Flashing Bright Red Warning Signs on the Charts… Plus 1 Stock That Looks Primed to Keep Breaking Out

- Can Xpeng Motors Eat Tesla’s Lunch in Humanoid Robots the Way BYD Did in EVs?

- Don’t Miss the Cup and Handle Pattern Our Top Chart Strategist is Tracking Now

- Can the AI Boom Push Broadcom Stock to a $2 Trillion Market Cap in 2026?